Electronic warfare (EW) is transforming rapidly and leading aerospace and defence contractors are investing in offensive and defensive capabilities to control the dense radio frequency environment and electromagnetic field of the battlefield.

The recent wars in Ukraine and in Gaza are demonstrating in real-time and in real life the variety of applications for EW capabilities in highly digitised and networked active combat areas. Major powers, including China, Russia, and the US as well as a growing number of smaller nations are seeking technological parity and investing in the latest EW capability.

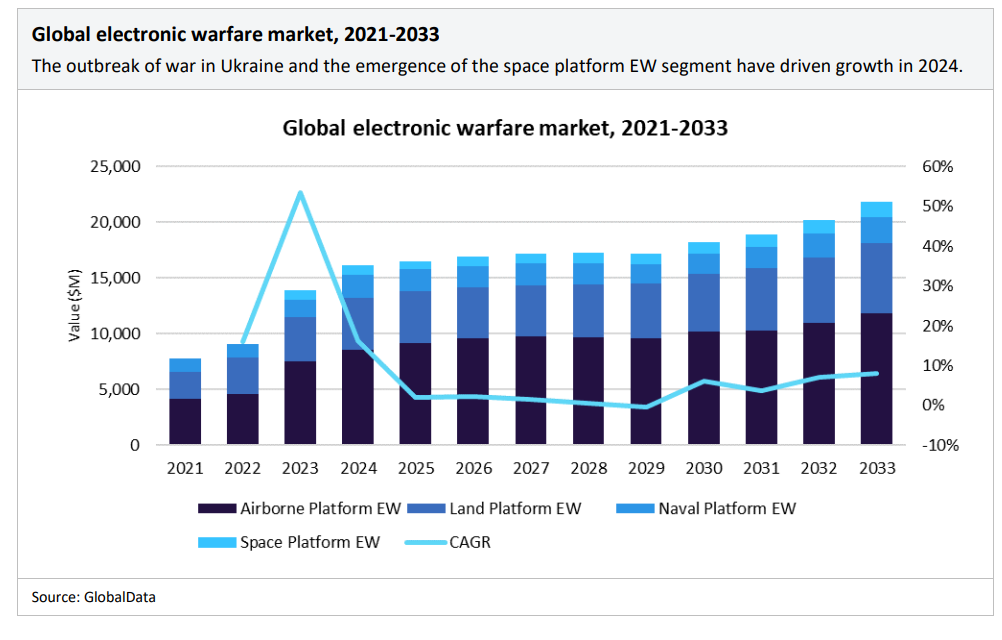

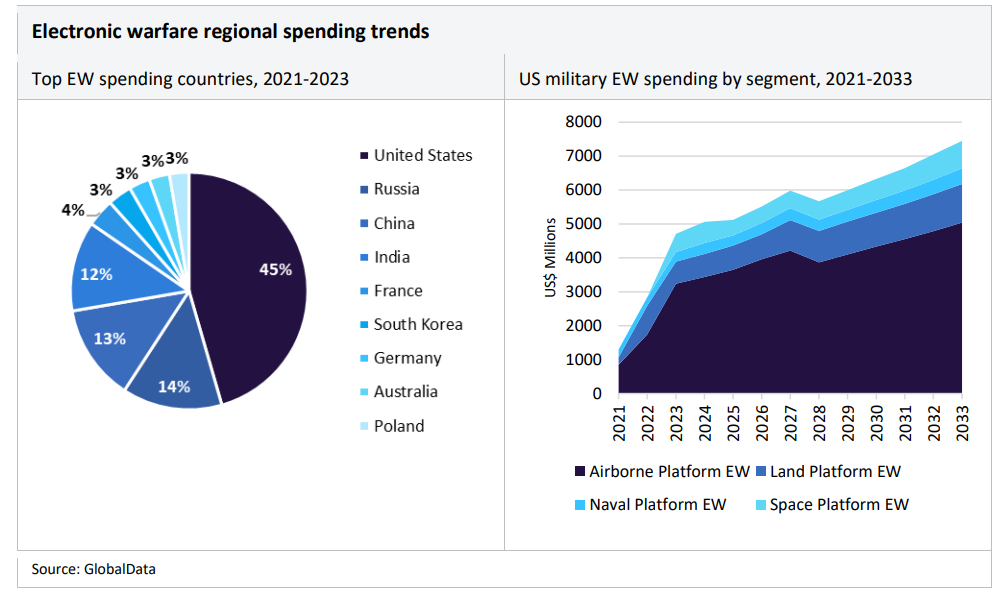

GlobalData analysis[1] estimates the EW market to be currently valued at $16.1 billion (2024). This is almost double its value of $9 billion in 2022. GlobalData analysts project the market to grow at 4.6% CAGR for 11 years from 2022, reaching $21.8 billion by 2033.

The market intelligence firm expects the airborne EW segment to remain the largest segment throughout the forecast period. In 2024, this segment was worth $8.5 billion and accounted for 52% of the total global EW market. The biggest drivers of growth are payloads and airborne early warning aircraft systems (AWACS) with many current 4th and 5th generation and future 6th Gen fighter jet programs seeking to integrate EW capabilities.

The market intelligence firm expects the airborne EW segment to remain the largest segment throughout the forecast period. In 2024, this segment was worth $8.5 billion and accounted for 52% of the total global EW market. The biggest drivers of growth are payloads and airborne early warning aircraft systems (AWACS) with many current 4th and 5th generation and future 6th Gen fighter jet programs seeking to integrate EW capabilities.

The growth of parallel defense segments such as missile defence, unmanned systems, and airborne C4ISR has further incentivized investment in multi-capable airborne EW products as commanders look for increasingly versatile solutions for countering emerging threats.

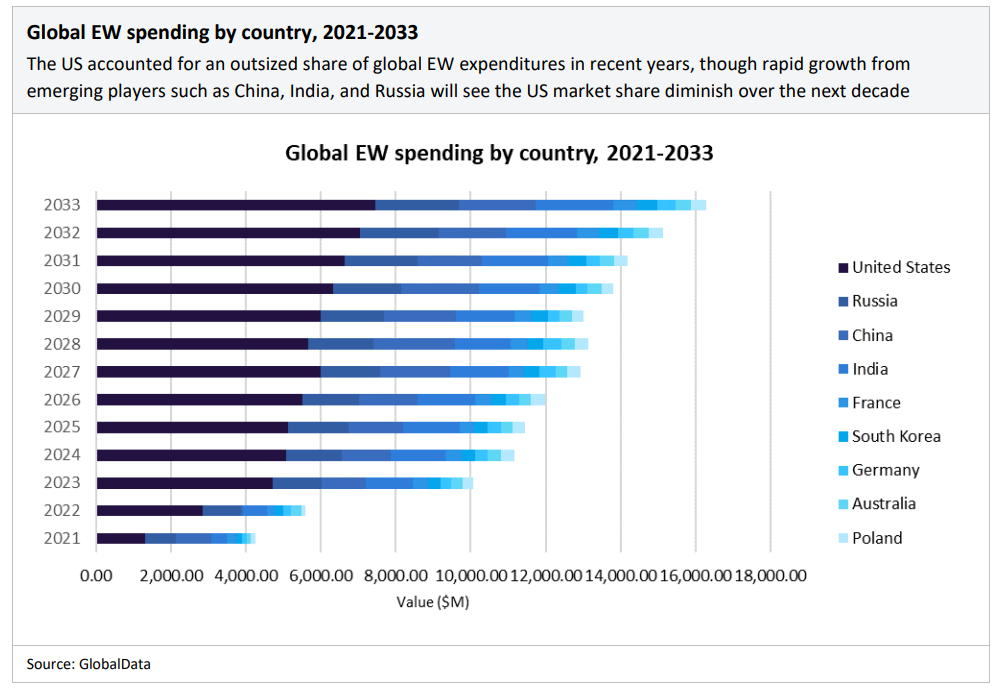

In terms of spend, the US is expected to remain the largest investor in the global EW market – a fact spurred on by concerns within the US Department of Defense over the risk of conflict with powers like China and Russia, as the relationship between these governments has become increasingly frosty over the past few years. The US DoD is actively pursuing an EW research, development, and integration program across all branches of the US armed forces.

Several European nations have expanded investments in response to the growing threat posed by Russian EW capabilities. India and South Korea are also increasing investments to modernise in line with new risks and the technology available.

Growing in complexity

The complexity of the digital combat space is driving demand for multi-capable and flexible solutions. According to GlobalData’s Patent Analytics database, the leading innovator within the EW market based on total patent publications is French defense prime Thales, whose expertise and investment in the EW value chain has seen it secure a large share of both European and North American electronic warfare markets. Recent patents granted to Thales cover a range of EW-related concepts such as GNSS geolocation, RF signal amplifiers, multimode antennas, and EM signature masking solutions.

EW patent activity was particularly lively between 2017 and 2020 and now many of those technologies and concepts have reached maturity levels and are being sold into the market.

Communications equipment must be capable of rapid deployment and ensure interoperability with existing platforms even in the most extreme environments, even while new technologies are making the electronic components that make up these systems smaller and hotter.

The rise of AI, both in data processing and decision-making, is increasing both the power consumption and heat generation of electronics. According to Stephen Riker, business development manager, Aerospace & Defense, nVent SCHROFF, this additional heat is creating one of the biggest challenges today for defense electronics engineers.

The challenges of SWaP

“The military is concentrating today on three main development drivers, based around size, weight, and power – or SWaP,” says Riker. “Engineers are being challenged to place more electronics into a smaller footprint – more processing power into a smaller envelope.

“Protecting and cooling these electronics is really one of the biggest challenges today for electronic packaging and for engineers, and it’s only going to become more complex as systems like AI and machine learning are introduced.”

Riker explains that these new systems are going to require tremendous amounts of computing power to perform the advanced functions required: “The electronics, processors, the chips themselves, are getting smaller and hotter. And when the footprint of a chip gets smaller, then it’s going to be more difficult to dissipate heat.”

For example, airframe upgrades often require expanding the space for electronics, which is difficult due to manufacturing constraints. The electronics package must fit inside the same space. And to add to all this – thermal cooling systems on military vehicles or aircraft need to be extremely tough.

Protecting technology in harsh environments

nVent SCHROFF has been pioneering electronic infrastructure for a wide range of applications, including C5ISR, PNT, radar, and weapons systems for more than six decades.

“nVent offers a tremendous line of products that are used in anything with high shock and vibration, which means they go into jets, tanks, satellites. There are a tremendous number of companies that use our product, anything that has high shock and vibration and critical components that need to be cooled,” Riker says.

Riker expands on how nVent SCHROFF products work in conjunction with the electronics.

“We have a line of products that dissipate the heat from the hot processor itself into a housing. We’re the world’s largest producer of what we call printed circuit board (PCB) retention products, which not only keep these hot computer assemblies in place, but also sink heat from that hot processor into an environment which will cool it. We’re talking about conduction cooling, forced air and liquid. These are the three avenues right now in the military that they are using to cool electronics. There are specific specifications, like VPX, VITA and SOSA that most of the military is adopting.”

However, developments in AI technology means that chips are running hotter than ever before.

“Many of the companies today are using conduction cooling, but with AI and machine learning, we’re going to see that expand. They’ll no longer be able to cool electronics just with conduction. They’re going to need to go to something else, like liquid, and we are providing that service to our customers today.”

While people have been using liquid cooling in home computers for years, Riker notes, for military use, systems need to be ruggedized: “That’s where some of the new specs, like VITA 48.4, give you the groundwork such for doing that, and we’ve used that specification to come out with some of our own products that solve that problem – liquid cooling in a ruggedized environment.”

Chip-level cooling – a new frontier

Riker explains that with AI the next step of thermal cooling technology will have to be different.

“I see AI revolutionizing data history and really being adopted throughout the military. Next generation processing power is really going to fuel all of this. Faster data rates. You’re going to need more complex software programs written for new systems, but it’s still going to be size, weight and power that will not change. SWaP is going to remain a huge consideration in electronic packaging.

“What we’re looking at now is not only liquid cooling, but liquid on chip, which is a little different, instead of packaging a board in aluminium, now you have a device that cools at the chip level. And that’s really, I think, the next frontier for us as a company.”

Download the report below to explore how nVent SCHROFF’s industry-leading enclosures can protect and cool high-tech military electronic systems on ships, tanks, ground control stations, aircraft and unmanned vehicles

GlobalData: Thematic Intelligence Aerospace, Defense & Security, Electronic Warfare, May 2024 ↑