As the world grapples with rising aggression and instability, the United States braces for an era of heightened military readiness and strategic deterrence.

GlobalData’s latest projections from its “US Defense Market 2023-2028” report indicate an uptick in defence spending, reflecting America’s resolve to navigate an increasingly uncertain global landscape.

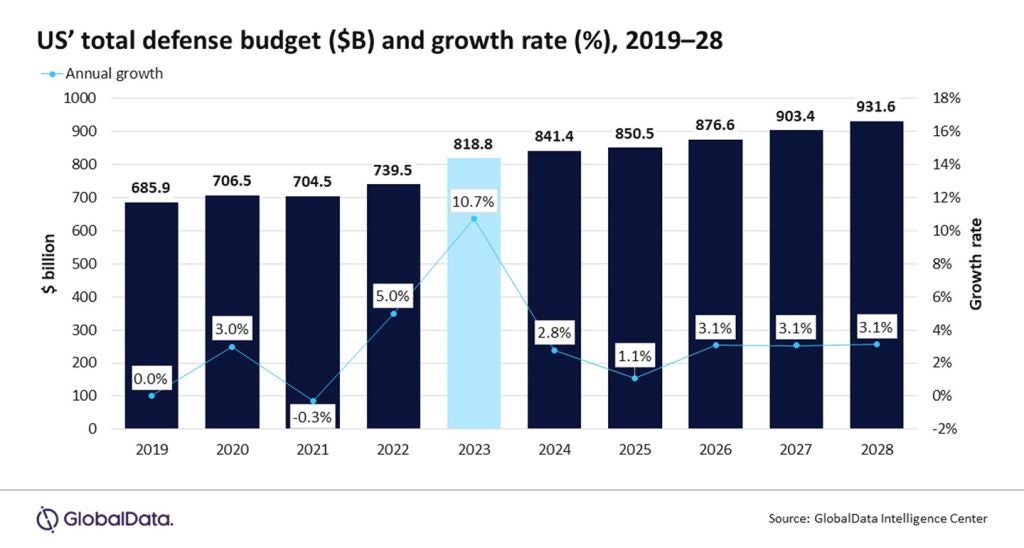

In response to mounting threats posed by authoritarian regimes and non-state actors, the United States is poised to intensify its investment in defence capabilities, with forecasts indicating a surge in expenditure. According to GlobalData, a leading data and analytics company, US defence spending is projected to skyrocket to $931.6bn by 2028, increasing from $818.8bn in 2023.

The escalating geopolitical tensions and the erosion of the rules-based international order have compelled US policymakers to prioritise military preparedness and deterrence. This imperative is underscored by Fox Walker, a defence analyst at GlobalData, who emphasises the need for the US to fortify its defence posture amidst an environment fraught with uncertainty.

Walker explains, “In an era of increased competition with large military powers and other national security threats, the US is strengthening its defence posture to operate in a more uncertain geostrategic environment.”

The forecasted surge in defence spending reflects America’s strategic imperative to bolster its capabilities in the face of global conflicts and emerging threats across multiple domains, including space and cyberspace, with a robust year-over-year increase of 10.7% in 2023 and a steady upward trajectory projected through 2028.

The driving forces behind this surge in defence expenditure are multifaceted, ranging from the ongoing global modernisation of defence technologies to the outbreak of armed conflict in critical regions aligned with American strategic interests. Key sectors earmarked for investment include military simulation and training, military fixed-wing aircraft, and missiles and missile defence systems.

Top ongoing programs in these sectors include Maxar Technologies One World Terrain training software, Lockheed Martin’s F-35, and the Patriot Missile Defence System.

Looking ahead, the trajectory of US defence spending hinges on various geopolitical and domestic factors, including the outcome of presidential elections. However, regardless of political dynamics, the defence industry can expect sustained growth in American investment and procurement initiatives, as tensions with global adversaries show no signs of abating.

The implications of a Chinese invasion of Taiwan

The looming spectre of a Chinese invasion of Taiwan casts a shadow over US national security strategy, amplifying concerns over the vulnerability of the semiconductor supply chain crucial to American technology. With the US heavily reliant on Taiwanese semiconductors, any disruption due to armed conflict could have far-reaching implications. As the US navigates increasingly restricted access to the South China Sea, heightened confrontation between the two global powers underscores the urgent need for robust defence spending.

Taiwan’s military modernisation has been dependent on the US in past years. They have secured various arms deals, including acquiring M109A6 Paladin howitzers, M1A2T Abrams tanks, Stinger missiles, and F-16 jets. These sales have drawn criticism and sanctions from Beijing, which views Taiwan as its territory and opposes US interference. In the face of conflict, Taiwan would be stripped of its purchasing power, as evidenced by Ukraine relying on donations following Russia’s invasion.

Countering China’s assertiveness in the Indo-Pacific

The escalating rivalry with China propels the surge in US defence expenditure. Recognising the significance of the Indo-Pacific theatre, the Department of Defense (DoD) is spearheading a strategic pivot to bolster regional stability and safeguard American interests. This shift reveals a concerted effort to fortify alliances, erecting a pro-US presence in the region. Central to this endeavour is the imperative to counterbalance Chinese military advancements, prompting sustained investment in defence initiatives.

China’s aggressive aerial activities in the Indo-Pacific, aimed at asserting its territorial claims and implementing the One China policy, have sparked concerns about escalating tensions in the region—recent incidents, including dangerous intercepts of US assets.

Fuelling a surge in defence spending by countering Russian aggression

The full-scale invasion of Ukraine in 2022 propelled the United States into a pivotal role, expanding its military and geopolitical support for the embattled nation. As the largest supplier of military aid to Ukraine since the Russian invasion, the US has played a central role in countering Russian aggression in Europe. With countering Russian military activities a top geostrategic priority, continued US support for Ukraine is all but assured, resulting in a projected increase in defence spending. Since January 2022, the US has allocated $46.6bn in security assistance, weaponry, and equipment to Ukraine, as per GlobalData’s intelligence on the US defence market.

Israel – Hamas conflict: Driving US defence spending

The recent escalation of tensions in the Middle East has intensified the logistical challenges faced by the Department of Defense (DoD), with simultaneous commitments to supporting both Israel and Ukraine. The conflict between Israel and the Hamas terrorist organisation has emerged as a primary catalyst for increased US defence expenditure. As Israel’s strongest ally and top recipient of US foreign aid, the United States has provided military equipment and financial support to the Israeli Defence Forces (IDF). Motivated by Israel’s strategic significance and security needs, US law mandates the supply of military technology to ensure Israel’s qualitative advantage, according to GlobalData’s “US Defense Market 2023-2028” report.

The US deployed its Ford Carrier Strike Group to the Eastern Mediterranean and directed the US Air Force to support the Israeli Defence Forces (IDF) in response to Hamas’ attack on Israel. Additionally, the US Department of Defense announced the delivery of munitions to Israel to replenish its stocks. This support coincides with other developments, such as the constructing of a new missile manufacturing facility in East Camden, Arkansas, by the joint Israeli-US venture R2S.

The defence industry can expect sustained growth in American investment and procurement initiatives, as tensions with global adversaries show no signs of abating.