GlobalData’s “Italy Defense Market 2024-2029” report reveals that while Italy’s defence budget will grow by 2029, due to economic constraints and political divisions, it is unlikely to reach the Nato target of 2% of GDP.

Despite efforts to boost defence budgets in the coming years, the report indicates that Italy’s spending will likely remain in the mid-1% range of its GDP.

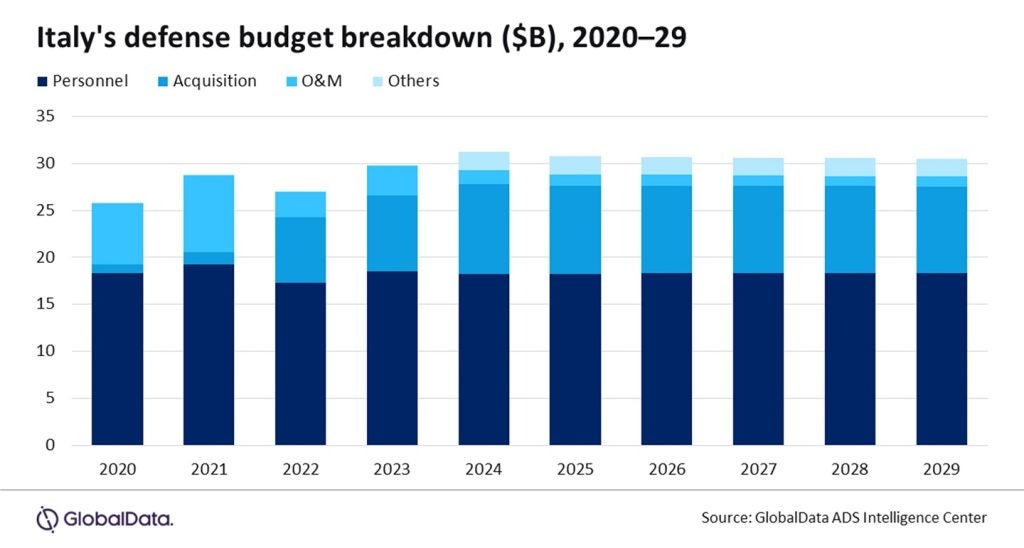

GlobalData projects Italy’s defence budget to grow from $25.8bn (€23.2bn) in 2020 to $30.5bn in 2029. While this represents a notable increase, it falls short of Nato’s expectations for member countries to allocate 2% of their GDP to defence. Wilson Jones, a Defense Analyst at GlobalData, emphasises that Italy’s goal of achieving this target is hampered by economic pressures and political instability that create uncertainty in long-term defence planning.

“Italy’s acquisition budget has the most substantial growth of any sector of Italy’s defence spending,” notes Jones. This growth is primarily driven by Italy’s investment in new military platforms such as shipbuilding programmes, combat jet acquisitions, and modernising mechanised brigades with armoured vehicles.

Italy has made advancements in its military capabilities in the past month with several major acquisitions. The Italian Navy secured a €1.6bn deal for five minehunters from Intermarine and Leonardo.

A €1.5bn contract was also extended for two evolved FREMM frigates. The Navy also initiated the construction of a fourth Offshore Patrol Vessel (OPV) under a previous €925m agreement. Furthermore, Italy is set to receive six MQ-9 Block 5 drones in a $738m arms deal with the United States.

Shifting budget priorities amid challenges

Despite the rise in the acquisition budget, which is expected to account for 30.3% of the overall defence budget by 2029, Italy’s defence spending remains heavily weighted toward personnel costs. With more than 200,000 uniformed personnel, the Italian armed forces are among the largest in Europe, and this results in a consistently high allocation toward personnel—projected to remain stable at approximately $18.2bn in 2024 and $18.3bn by 2029.

Conversely, the budget for operations and maintenance (O&M)—which covers activities such as military exercises, overseas deployments, coalition operations, and maritime security missions—will see a reduction. This trend could undermine Italy’s military readiness and its ability to maintain a high level of operational effectiveness, particularly in the Mediterranean region.

The expected decrease in O&M spending raises concerns about how Italy will balance its acquisition of new platforms with the ability to operate and maintain them effectively.

Political instability: A persistent roadblock to the 2% target

The report also highlights how Italy’s political environment challenges achieving its defence spending goals. Frequent political turnover, coalition disputes, and legislative gridlock have made it difficult for Italy to establish and adhere to a cohesive, long-term defence strategy.

“While the Italian government has committed itself to Nato’s 2% defence spending target, challenges remain in making this goal a reality,” explains Jones. “Italian politics are fractious, where party infighting, resignations, institutional gridlock, and the emergence of new parties are common.”

This political volatility directly impacts defence policy, making it difficult to ensure stable funding and sustained support for military modernisation initiatives. As a result, while Italy is making strides in acquiring new military hardware, questions remain about how effectively this equipment will be integrated and utilised within its armed forces.

Implications for the defence industry and partners

For defence contractors and industry stakeholders, the insights from GlobalData’s report reveal both opportunities and challenges. The increase in Italy’s acquisition budget presents opportunities for defence firms. However, potential suppliers and partners must also navigate the risks of Italy’s economic uncertainties and unpredictable political environment.

The Italian defence sector’s uneven allocation of resources—favouring acquisitions over operations—could also impact defence firms’ business strategies. Companies may need to focus on selling platforms and offering maintenance, training, and lifecycle support to ensure that new equipment can be deployed and sustained in operational scenarios.

Balancing ambition with reality

GlobalData’s report suggests that while Italy will likely make headway in modernising its military capabilities, achieving the Nato 2% spending target will remain challenging and uncertain.

Italy’s defence sector is at a crossroads where acquisition plans meet practical constraints. The road to reaching Nato’s spending goal is riddled with obstacles, and how Italy’s government addresses these challenges will determine the future trajectory of its defence policy and military readiness. For now, defence stakeholders must keep a close eye on Italy’s landscape and adapt to the opportunities and risks it presents.