GlobalData’s latest report states that Colombia confronts escalating security threats from armed militias, border disputes, and internal unrest, triggering a surge in defence spending to $18bn by 2029.

However, corruption scandals and constrained budgets hinder foreign investment, posing challenges to sustained growth.

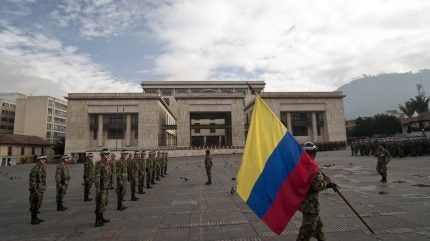

Colombia stands at a juncture as it grapples with persistent security threats from various fronts. Armed militias, border disputes with Venezuela, and internal conflicts persistently undermine national stability. In response, Colombia’s defence market is poised to undergo growth, reaching an estimated $18bn by 2029, according to GlobalData’s Colombia Defense Market 2024-2029 report.

The report highlights a 7% Compound Annual Growth Rate (CAGR) in defence expenditure, indicating the nation’s resolve to fortify its security apparatus amidst mounting challenges. Despite signing a peace accord in 2017, factions within groups like FARC and the expanding influence of ELN continue to pose security threats. This necessitates a proactive approach to bolster defence capabilities and ensure national sovereignty.

Key statistics from the report reveal increases in defence spending over the forecast period. From $8.9bn allocated in 2020, Colombia’s defence expenditure is projected to soar to $13.7bn by 2024, marking an 11.2% CAGR during 2020–2024. Moreover, acquisition expenditure, crucial for modernising military capabilities, is anticipated to witness a 14.5% CAGR, reaching $12.2bn by 2029.

However, amid the surge in demand for military equipment, Colombia’s defence market faces challenges. Recent revelations of high-level corruption within the armed forces have shaken public trust and deterred foreign investment. Allegations of collaboration with criminal groups and mismanagement of funds emphasise the urgent need for transparency and accountability in defence procurement processes.

Furthermore, despite growing, Colombia’s defence budget remains relatively modest compared to global standards. With acquisition expenditure representing an average of 5.7% of the total defence budget during the historic period, the market struggles to attract foreign arms suppliers. Despite forecasts indicating an increase of 7% over the forecast period, the slow growth trajectory poses obstacles to procuring high-tech defence equipment at scale.

In 2022, US-based Sikorsky reached an agreement with the Corporación de la Industria Aeronáutica de Colombia (CIAC) to supply spare parts for Colombia’s Black Hawk helicopter fleet. Additionally, Sikorsky and CIAC have collaborated on managing the Black Hawk Flight Simulator Center in Colombia.

Nevertheless, specific sectors within Colombia’s defence market exhibit promising growth prospects. Naval vessels, military fixed-wing aircraft, and military land vehicles emerge as key investment areas. Notably, the military land vehicles market is expected to grow at a CAGR of 12.7% between 2023 and 2028, becoming the third-largest contributor to Colombia’s defence market.

As Colombia navigates these challenges, the government remains committed to modernising its defence capabilities. Plans to acquire frigates, logistic support vessels, and transport aircraft show the nation’s determination to enhance its security infrastructure. However, addressing corruption and increasing defence spending transparency will be imperative to attracting foreign investment and ensuring sustainable growth in the defence market.

Colombia’s defence market is poised for transformation amid escalating security threats and ambitious modernisation plans. Overcoming internal obstacles and fostering greater transparency will be vital to realising the nation’s defence objectives and securing long-term regional stability.