As Bahrain’s defence market shifts, newcomers face hurdles in breaking into a landscape long dominated by US suppliers despite political unrest.

However, lucrative opportunities in sectors such as missiles and aircraft present enticing investor prospects.

US dominance in Bahrain’s defence market

According to GlobalData’s Bahrain Defense Market 2024-2029 report, over 87.8% of Bahrain’s platform import requirements between 2016 and 2022 were satisfied by US manufacturers, with naval vessels and surface combatants leading the procurements.

The presence of US defence companies, fortified by relationships and contracts, poses a challenge for new entrants seeking to penetrate the market. Moreover, the Comprehensive Security Integration and Prosperity Agreement signed between the US and Bahrain in September 2023 further cemented this dominance.

Political instability adds another layer of complexity to the Middle Eastern nation’s defence landscape. Local unrest, mainly stemming from the Shia population, has sporadically disrupted business operations and supply chains. Despite these challenges, Bahrain’s economy has demonstrated resilience, maintaining steady GDP growth over the last decade.

High entry barriers exacerbate the challenge for investors eyeing their defence market. Complex procurement processes, stringent regulatory frameworks, and the need to establish trust and credibility within the market contribute to the complexity. These barriers require financial resources, industry expertise, and strategic alliances.

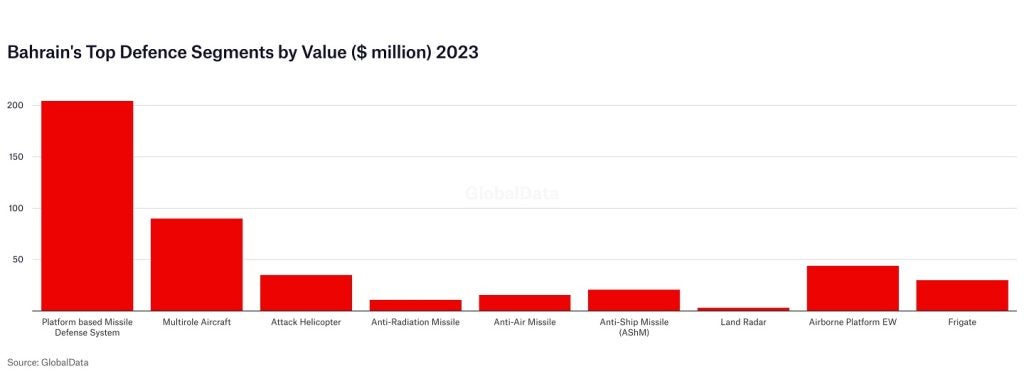

However, amid these challenges lie lucrative opportunities. Sectors such as missiles and missile defence systems, military fixed-wing aircraft, and military rotorcraft offer investment potential. The missiles and missile defence systems sector alone is expected to reach a cumulative value of $1.3bn over the forecast period of 2023–2028.

Military fixed-wing aircraft, led by Bahrain’s purchase of 16 F-16 Block 70 aircraft from Lockheed Martin, presents a $560m opportunity. Additionally, the military unmanned maritime vehicle sector is the fastest-growing, with a projected CAGR of 5.9%.

Defence expenditure and procurement initiatives

Bahrain’s defence landscape shifts as the country navigates through political tensions, modernisation demands, and strategic alliances. Bahrain’s defence market presents challenges and opportunities for global players, with a steady rise in defence expenditure and a focus on acquiring defence capabilities.

Bahrain’s defence sector is undergoing a transformative phase fueled by geopolitical pressures and internal imperatives. The country’s defence expenditure, historically driven by the need to modernise its armed forces, is set to experience growth over the forecast period of 2024-2029.

According to GlobalData’s Bahrain Defense Market 2024-2029 report, Bahrain’s defence budget is projected to increase from $1.52bn in 2024 to $1.74bn in 2029, marking a notable uptick in investment.

Bahrain’s procurement initiatives are key to this surge in defence spending, particularly its acquisition of aircraft and platform-based missile defence systems from the US. Bahrain recently announced a $2.2bn purchase of 50 M1A2 SEPv3 tanks from the US.

Political instability, stemming from historical tensions with neighbouring countries and internal dissent, continues to shape defence priorities. Bahrain’s strained relationship with Iran, coupled with the country’s Shia majority population, presents ongoing challenges, fueling defence expenditure to bolster measures and deter regional threats.

Moreover, Bahrain’s alliances with geopolitical players, notably the US and the UK, shape defence procurement strategies. The longstanding partnership with the US, dating back to Bahrain’s independence, has deepened in recent years, with defence procurement contracts signed, including acquisitions of AH-1Z Viper attack helicopters and F-16V combat aircraft.

Bahrain’s defence market emerges as a dynamic arena, offering opportunities for defence industry stakeholders. However, navigating the market’s complexities, including high entry barriers and regulatory frameworks, remains a challenge.

Yet, with alliances, modernisation imperatives, and geopolitical dynamics driving investment, Bahrain’s defence market presents a landscape with potential for global players seeking to capitalise on opportunities in the region.