Elbit Systems has been awarded a $135m (NIS548.46m) contract to establish an artillery ammunition factory for an unnamed international customer, which will be completed over the coming 24 months, according to a 29 October press release.

The company currently operates a number of artillery ammunition manufacturing sites with multiple production lines running in a range of countries, with senior Elbit Systems officials stating that there was “growing demand” from governments seeking to enhance sovereign capabilities.

Elbit Systems offers a number of munitions in the artillery sector, with a current production capacity of more than 250,000 shells per year, according to available corporate information. Typically, the company does not reveal exact customer details regarding its international defence contracts.

However, Elbit Systems is known to be seeking to expand its artillery offerings into the European market, reaching a teaming agreement with KNDS to promote its newly developed EuroPULS rocket artillery capability to Nato members on the continent.

Among its offerings are the M454 (Super HE), which is said to have five times the effect of traditional high-explosive (HE) projectiles, as well as extended-range HE and super-high explosive projectiles and advanced charge systems for 155mm gun firing systems with 39, 45 and 52-calibre barrels.

In July this year, the company was awarded a contract worth approximately $60m to supply thousands of 155mm artillery shells to the Israel Defence Forces’ Artillery Corps.

Earlier, in May, Rheinmetall and Elbit Systems conducted a live fire demonstration of an automated 155mm L52 wheeled self-propelled howitzer at the Shivta firing range in southern Israel, attended by high-ranking officials of the armed forces of the UK, Germany, the Netherlands and Hungary.

Global artillery market expands

The drive for increased sovereign ammunition manufacturing requirements can be attributed to the demand for artillery platforms, driven in part by the ongoing Ukraine-Russia war where the use of the capability has had a defining impact on the battlefield. More so than any other munition or weapon system, the provision of artillery ammunition and platforms is seen as a key capability, particularly as battlelines return to a more static form with the onset of winter.

Several European countries are boosting their own stocks of artillery shells as the ongoing support to Ukraine begins to have an effect on war reserve materiel, with German defence prime Rheinmetall among a number of companies to have been placed on contract to increase ammunition production.

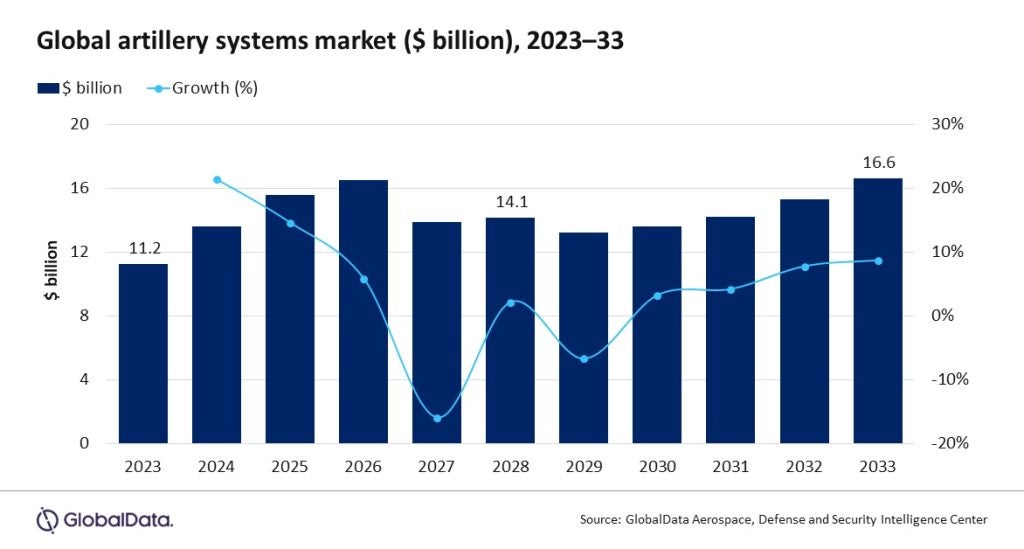

According to GlobalData analysis, as part of the replacement and modernisation efforts of legacy artillery systems, countries across the globe have initiated multiple programmes for the development and procurement of modern artillery systems. This will drive worldwide cumulative spending on artillery systems to $153bn between 2023 and 2033, driving the global market for artillery systems to $16.6bn in 2033.

GlobalData’s Global Artillery Systems Market 2023–2033 report reveals that the market for artillery systems will grow at a compound annual growth rate of 4% between 2023 and 2033. Conventional wars, like the one between Russia and Ukraine, have witnessed extensive usage of artillery systems, which in turn has led several countries to reassess their capabilities and include modern artillery systems within their inventory.