In 2019, the Government Accountability Office (GAO) recommended that the US Department of Defense (DoD) conduct a comprehensive assessment of the effect of their contract financing and profit policies on the defence industry.

Accordingly, the DoD launched a comprehensive Defense Contract Finance Study (DCFS) at the end of 2019 to assess defence industry financial performance over a twenty-year timeframe. The DoD has now released their DCFS findings on 10 April 2023.

The DCFS integrates the results of studies undertaken by universities, a Federally Funded Research and Development Center, public comments, and analyses by the Department. General investigative areas included financial health, financing regulations, insight into the commercial marketplace, and impacts to subcontractors, including small businesses.

This assessment is the first study of the financial implications of the DoD’s procurement process in 37 years. The last was conducted in 1985 in the Defense Financial and Investment Review.

The latest DCFS findings tell us that in aggregate the defence industry is financially healthy and the DoD does not need to modify its weighted guidelines that arrive at objective profit positions for negotiation. Although, the department does need to change their impact on subcontractors and suppliers, those that do not receive favourable cash flow benefits.

The DoD is keen to attract new entrants into their defence industrial base (DIB) while retaining existing participants. At the cost of maintaining considerable benefit to large defence companies, smaller businesses supplying resources and subcontracting work hardly benefit in comparison.

Suppliers and subcontractors

The main problem found in the report was the impact on smaller business interest. Suppliers and subcontractors are not receiving their due cash flow benefits, at least as much as it would take to fulfil the DoD’s ambition of attracting newcomers to the DIB.

“Defense subcontractors and suppliers generally do not receive the favorable cash flow benefits to the same extent enjoyed by defense prime contractors”, the reports states. “This is a crucial finding, as GAO has noted estimates of 60 to 70% of defense work being performed by subcontractors”.

Moreover, “Small businesses are particularly vulnerable when it comes to having cash on hand to cover operating expenses. In general, they do not have the same opportunities to obtain working capital as their larger counterparts”.

In response to this, the DoD plans to introduce a series of regulations and legislation to counteract this problem. Thereby widening its growing DIB to meet the new military demands that have come as a result of the current security climate, in which the People’s Republic of China have become “a pacing challenge” according to the President’s FY 2024 Budget.

These new measures include, but are not limited to extending the benefits of prompt payment to subcontractors; improving payment protections and payment oversight for subcontractors; improving the ability of subcontractors to assert any non-payment issues; exploring and piloting a new form of contract financing to meet the general financing needs of small businesses.

A healthy financial environment

While the DoD have some work to establish a level playing field as small businesses struggle to compete in the DIB, the report does say that the defence industry is “financially healthy”.

The University of Virginia’s Darden School of Business, one of the universities contributing to the DCFS findings, confirmed that “the Department does not find a need to modify its weighted guidelines structured methodology of arriving at objective profit positions for negotiation”.

It was found that defence companies have higher total returns to shareholders compared to their commercial analogues, or when compared to broad equity market indices such as the S&P 500 Darden Business School states.

It was also found that in eight of nine key financial metrics, defence contractors out-performed commercial counterparts. Those metrics include Total Shareholder Return, Return on Assets, Return on Equity and Cash Flow Return on Net Assets, Darden added.

However, it is noteworthy that the report also describes some contradiction between the comments of industry associates and the financial data collected.

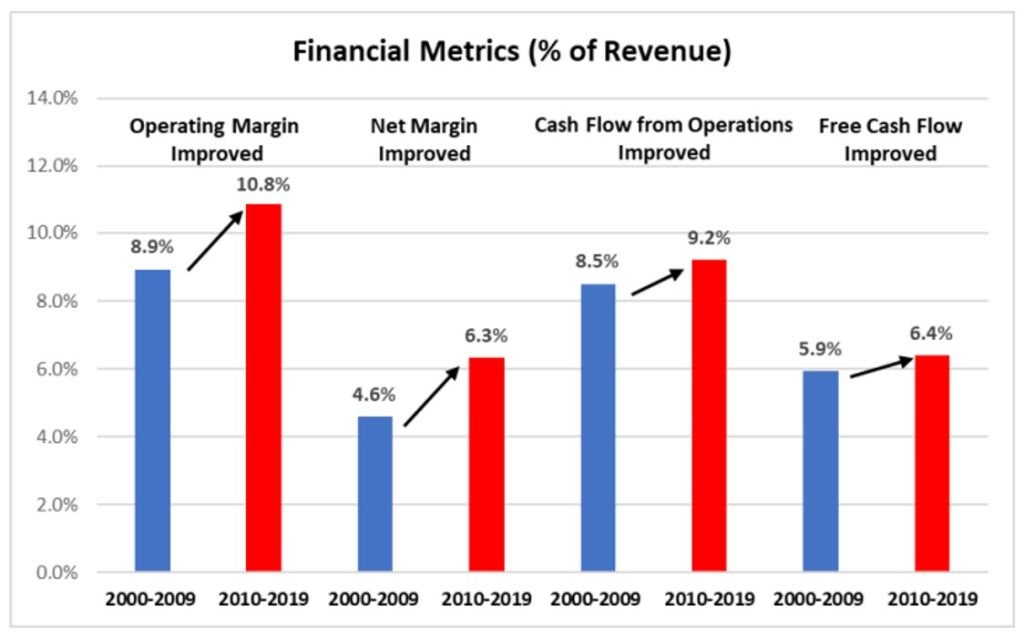

“One defense industry association characterized the health of the DIB as being ‘fair to poor’; another described it as ‘at risk’; and another cited a 2022 defense industry association report which gave it a ‘failing grade’. In light of the data in Figure [below] and the details provided in the [university] reports, these industry association comments regarding the health of the DIB are difficult to reconcile with defense industry financial data”.

Providing the innovation the US military needs

Despite improving profit margins and cash generation for defence contractors in 2010-2019 compared to 2000-2009, the share of contractor spending on independent research and development and capital expenditures declined while cash paid to shareholders in dividends and share repurchases increased by 73% according to Darden.

It is reasonable to believe that the reduced investment in independent research and development by industries could stifle military innovation. As the report signals, suppliers are already under some strain in terms of their cash flow to deliver on the new technologically sophisticated and complex needs of the military today.

Meanwhile, the US intelligence community consider partnerships with the private sector to be key to military innovation in order for the US military and their allies to maintain a competitive edge over their adversaries.

In fact, the director of the Central Intelligence Agency (CIA), William J. Burns, has stated in a US Senate Select Committee on Intelligence that “the revolution in technology is not only the main arena for competition with the People’s Republic of China [PRC], it’s also the main determinant of our future as an intelligence service”.

This leads us to question where innovation will continue to be made considering that it is widely expected that industry is the single driver of innovation, not the military end-user. It is not just about the ability to maintain a sustainable profit stream, but also to deliver innovative tech solutions.