The UAE’s continuing growth of its indigenous defence industrial base was prevalent at the IDEX 2023 exhibition and conference in Abu Dhabi, with local and international companies looking to harness the buying power of a region somewhat sheltered from turbulent global markets.

The combined value of contracts signed at IDEX, which took place from 17-21 February, totalled AED23.34bn ($6.37bn) throughout the week, indicating the Middle East defence industry remains a significant operator in the market. Examples of products arousing interest in the UAE’s EDGE Group are precision-guided and loitering munitions.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataEDGE Group dominated the second day of IDEX, with the company firming up deals the Desert Sting 25 and Shadow loitering munitions for AED4.7bn ($1.28bn) and AED1.33bn ($354m) respectively. The Desert Sting 25 – developed by EDGE entity Halcon – will supply lightweight precision-guided glide munitions designed for aircraft and unmanned aerial vehicles.

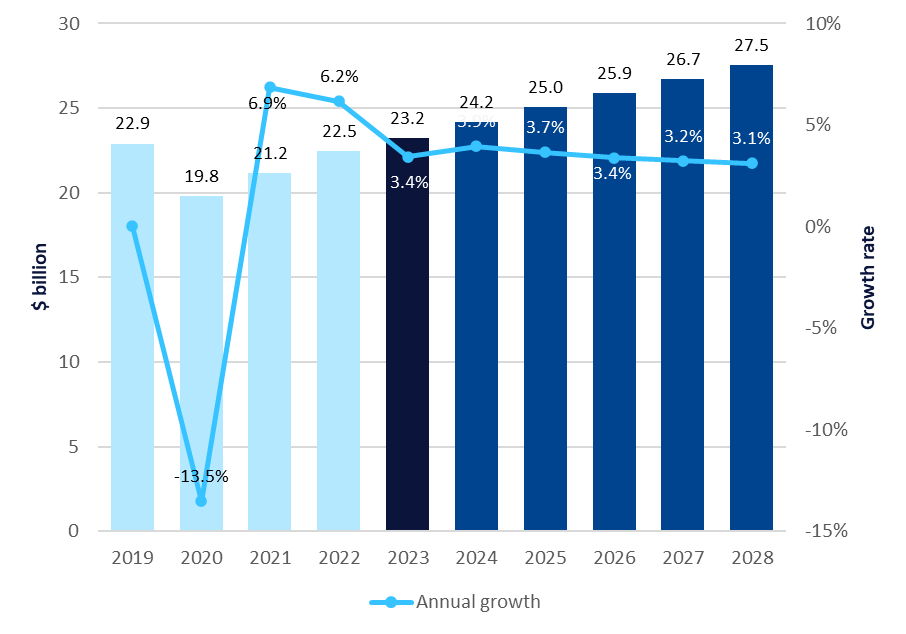

GlobalData’s “The UAE Defense Market 2023-2028, Key Challenges” report says that the UAE wants to become self-sufficient in space technologies, artificial intelligence, 3D printing, and information technologies.

As part of this plan, the UAE unveiled a new defence conglomerate EDGE in November 2019, formed with the bringing together of the nation’s defence firms, and charged with the development of weapons for the country’s military.

GlobalData’s “The UAE Defense Market 2023-2028” report says that missiles and missile defence systems have a cumulative value of $4.1bn, ranking as the second-largest sector in the UAE defence market. The strategy recognises that EDGE provides defence technology to UAE Armed Forces by supporting and upgrading existing technologies to meet emerging threats quickly.

In addition, the threat of Iran meddling in Middle East affairs will compel the UAE to maintain its robust defence posture, thus ensuring defence spending. The country is wary of expanding Iranian influence in the Middle East, so it has consistently ranked among the largest defence spenders in the region and has typically leveraged its extensive oil reserves to drive its economy.

International cooperation

Another objective for EDGE was in developing co-creation opportunities and supply contract deals. EDGE and British-based BAE Systems explored co-creation opportunities across the UAE’s defence industry and supply contracts, with an Memorandum of Understanding (MoU) signed to further these aims.

In this agreement, BAE Systems and EDGE Group would work to offer technologies and capabilities across the UAE across the cyber, maritime, and air domains in support of the UAE’s industrialisation efforts.

Further, EDGE also also signed a cooperation agreement with Tanzania’s military, the Tanzania People’s Defence Force.

International participation included the range of western and eastern defence companies. With western defence budgets growing, despite market pressures, IDEX was also a time for the defence community to reflect on the future.

Among other contracts, French company Naval Group signed AED407m ($110m) deal to procure anti-torpedo CANTO systems and MU90 torpedoes. Swedish company Saab secured an AED108m ($29m) contract to provide maintenance services on GlobalEye 6000 services.