The Brazilian smart weapons manufacturer SIATT – a recent addition to the Emirati defence conglomerate EDGE Group, which purchased a 50% stake in the Sao Paulo company in September 2023 – has announced plans to considerably expand the company’s capacity and personnel.

According to a press release from 16 January 2024, the Group’s support will help SIATT to expand its headquarters and manufacturing base in the city of São José dos campus sevenfold, from 1,000 square metres to 7,000.

In addition, the business will also hire from the local talent pool, which will see significant job growth, with the number of direct employees reaching 200, and indirectly generate more than 600 further positions.

Before the acquisition of SIATT, EDGE Group signed a co-development agreement with the Brazilian Navy for advanced long-range anti-ship missile technology, as part of the MANSUP national anti-ship missile project, for which SIATT is providing the guidance, navigation, control and telemetry systems. The newly increased capacity will allow for additional laboratory space as well as administrative buildings.

EDGE Group FDI to help rebound Brazilian jobs

Since EDGE Group tapped into the Brazilian defence market throughout 2023, the country’s job market saw considerable growth.

“Growth in the domestic defence market continues to benefit the Brazilian economy as the government seeks to offset a spike in unemployment during the Covid-19 pandemic,” GlobalData Defence Analyst, Tristan Sauer observed. “As the Brazilian military undergoes a force-wide modernisation efforts, FDI from emerging defence players such as EDGE Group will facilitate the evolution of the Brazilian defence sector into a critical regional player.”

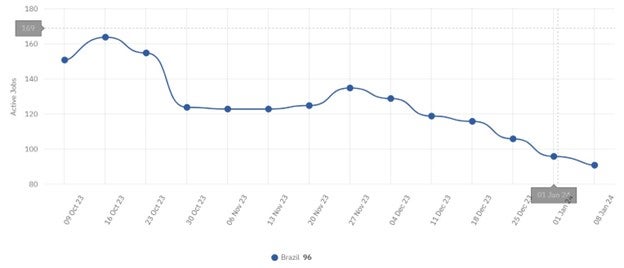

However, since the tail-end of 2023, Brazil’s active jobs saw a steady decline, as can be observed from the graph below.

However, it appears EDGE’s support for SIATT may serve to counteract this reduction, especially within the local economy of the state of São Paulo, located on the nation’s eastern coast, just south of Rio de Janeiro.

Furthermore, other foreign investors in Brazil’s defence market have reached certain milestones too. The French Naval manufacturer, Naval Group, has also supported Brazil’s naval industry – from resources for its first indigenously-built submarine to naval nuclear power engineering.

New job listings for new defence sectors such as these will rebound Brazil’s job decline.

Our signals coverage is powered by GlobalData’s Disruptor data, which tracks all major deals, patents, company filings, hiring patterns and social media buzz across our sectors. These signals help us to uncover key innovation areas in the sector and the themes that drive them. They tell us about the topics on the minds of business leaders and investors, and indicate where leading companies are focusing their investment, deal-making and R&D efforts.