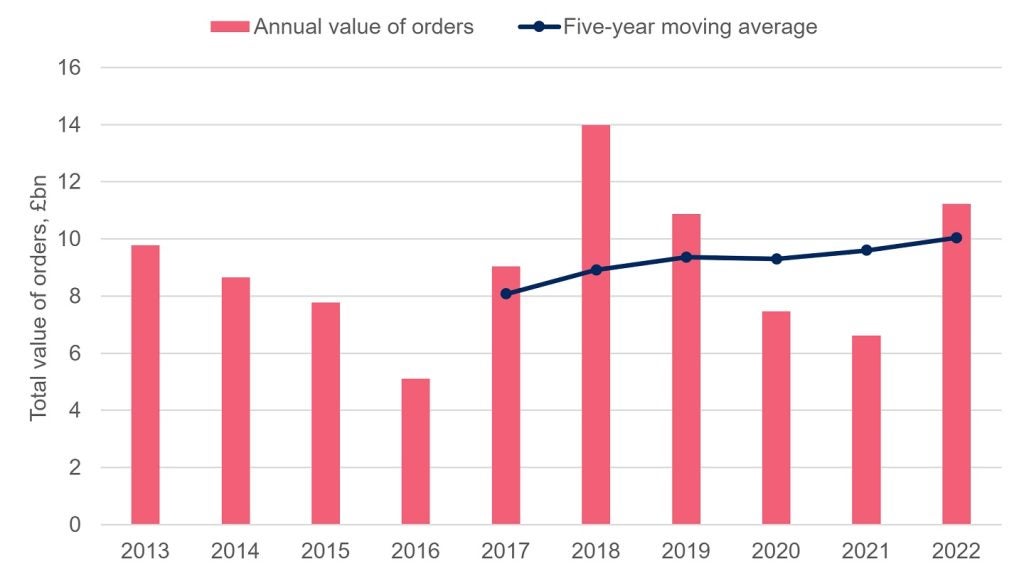

The UK’s defence exports have increased significantly over the last complete year, rising from £6.6bn ($8.3bn) in 2021 to £11.2bn in 2022, an approximate 70% increase in nominal prices, according to information released by the country’s Department for Business and Trade.

Outlined in its 17 November publication of the UK’s military exports, the information was obtained by surveys carried out by UK Defence and Security Export (UKDSE), combining contact data from the US, Canada, Australia, and Nato member states, with available market intelligence and media coverage.

In its executive summary, the UKDSE stated that the increase in 2022 was “due primarily to new contracts in the Middle East and Europe”, as well as export of helicopters to Canada. Over a five-year period 2018-2022, annual UK defence orders averaged £10bn.

However, the 2022 figures were down from a high of £14bn recorded in 2018, at the start of the five-year reporting period.

Regional breakdown of UK defence exports

According to the analysis carried out by the UKDSE, the Middle East was on average the largest market for UK defence export orders over the five years from 2018 to 2022, accounting for an average of 43% of the total value of orders across that period.

However, five-year moving average exports in the Middle East have shown a decline since 2019, reflecting a drop in in-year orders following large contracts in 2018 of Typhoon fighters and Brimstone missiles to Qatar, the report stated.

Five-year average exports to Europe increased from £0.8bn in 2018 to £2.2bn in 2022, overtaking those to North America in 2020. Most exports to Ukraine in 2022 are not counted as they have mostly been committed as part of a military assistance package following Russia’s invasion in February 2022.

Further UKDSE analysis found that over the five years from 2018 to 2022, on average the aerospace sector was estimated to have accounted for 68% of the value of UK defence exports and was the largest sector by value for the period 2013-2022.

Bumper deals for sales to Middle East countries will have contributed to this trend, with new aerospace projects such as the Future Combat Aircraft Systems, also known as FCAS, integrating defence primes in Europe and Japan with a view to the production of a sixth-generation fighter.

US still market leader for military exports

The US has been the largest defence exporter globally from 2013 to 2022, with the five-year average annual value for the country increased markedly in 2020, due in large part to high value aircraft orders to multiple countries in that year, UKDSE found.

The next largest exporters continue to trend lower than the US, although France’s five-year average has increased since 2020 due to winning aircraft contracts with various countries in 2021 and with Indonesia in 2022, as well as a contract for frigates to Greece, while South Korea saw a substantial increase in 2022 due to major deals with Poland, the UAE and Egypt.

Russian defence exports are less understood, with the UKDSE admitting that it did not have information on Moscow’s defence contracts in 2022. Knowledge of China’s defence exports was even more opaque, although the UKDSE stated that open-source information suggested that it was “a significant defence exporter”.

Poland stands out as key importer of defence equipment

UKDSE analysis revealed that over the five years from 2018 to 2022, the average annual Rest of World (non-UK) defence exports to Saudi Arabia exceeded those to all other countries, while the UAE saw a large increase in its five-year average orders in 2021, in large part due to an order of aircraft from France in that year.

In addition, Poland also saw a large increase in defence imports in 2022, with exports to the country exceeding those to all other national markets. South Korea accounted for most exports to Poland in 2022, including K239 Chunmoo Multiple-Rocket Launcher Systems, FA-50 aircraft and other military equipment.