Long-run macro themes can be tricky to translate into equity portfolio strategy, but war could prove an exception to this rule. The resulting prospect of sustained expansion of government demand for military equipment is an argument at least for a passive strategy – on the rising-tide-lifts-all-boats rationale – of overweight exposure to defence sector stocks.

Their relative outperformance since Russian invaded Ukraine eighteen months ago will not just be supported by the dire prospect of the war dragging on but should also extend into the ensuing cold peace. This investment thesis passes the test of at least three possible objections.

Defence spending trends during and after war

An initial objection would be that wartime surges in defence spending should recede after hostilities end. This ebb and flow of the war tide echoes the underlying driver of geopolitical tensions.

Even if the rise of China challenging the global dominance of the US maintains such tension above the low level which the world enjoyed during the post-Cold War unipolar moment, the Cold War history of détente points to periodic relief. We recently highlighted a potential example in the crucial case of Taiwan, where domestic politics – via next January’s elections – could lower the temperature for a time.

The answer to this point hinges on the war in Ukraine – or rather its aftermath. The spur to rearmament is threat, and the lived experience of threat from Russia after a protracted and bloody war will underpin that spur more reliably even than fluctuating perceptions of the likelihood of war with China.

This is not to make an overly literal argument about ‘forever’ war in Ukraine. Even if, as seems all too plausible, a formal ceasefire or armistice led to some kind of partisan and/or civil war, the small arms combat involved would not in itself move the needle of vast defence budgets.

The key point, instead, is that no plausible outcome of the Ukraine war spells a peace dividend. Even in defeat, nuclear-armed Russia could not be absorbed into the US system after the fashion of America’s vanquished enemies in 1945; and at least until global oil demand finally succumbs to the global energy transition, Russia would have resources for revanche. The resulting armed stand-off – a throwback to the original Cold War in every sense including defence spending – would be sharper still in the opposite case of Russia emerging from the present war with territorial gains.

Depleted inventories drive rearmament investment

The Ukraine war also lies at the heart of the answer to a second, inventory-based objection to this thesis about rearmament as a long-term equity investment theme.

If it were only a matter of rebuilding depleted stockpiles, this objection would have some force. For that done, demand would logically plateau unless live armed conflicts escalate or new ones break out. But eighteen months of fierce combat in Ukraine have delivered a sharper lesson.

The defence industrial base of the US and its military allies has so shrunk since the Cold War as to be unfit for the purpose of supporting high-intensity territorial warfare against peer adversaries. President Biden exposed this reality with remarkable (unintended?) frankness when admitting in a CNN interview on 9 July that “we are running low” on 155mm artillery shells – a combat staple in the Ukrainian theatre.

The US, along with Europe and the rest of its alliance system, now face a political imperative to expand military industrial capacity. This will drive multi-year capital intensive investment.

The war turbo-charges an expensive arms race

This leads to a third and final objection hinging on the question: is the military ‘shopping list’ sufficiently long and weighty to underpin defence sector companies’ structural top-line growth?

The new capacity involved in the plan to quintuple US artillery shell production by 2028 is cheap compared to some of the programmes – such as the F-35 fighter aircraft platform responsible for Lockheed Martin’s latest quarterly earnings uptick – that are regularly in the sights of critics of Pentagon “boondoggles”.

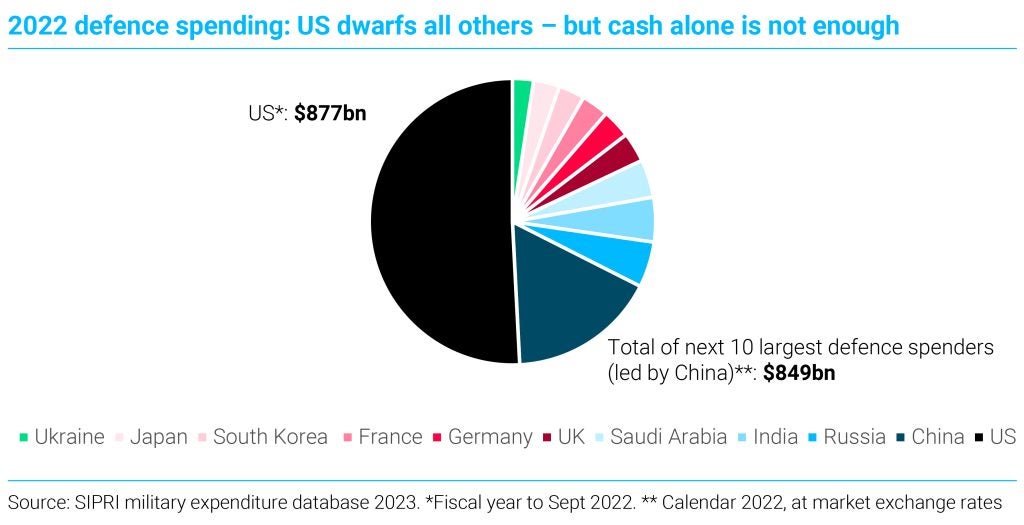

Such critics argue that America’s already preponderant defence spending (see chart below) need not be yet further increased but merely re-directed towards neglected and affordable priorities highlighted by the war in Ukraine.

The answer to this comes in two parts. Firstly, by no means all of the kit revealed by the Ukraine war to be in structurally short supply is cheap. This goes in particular for all kinds of air defence equipment.

Secondly, and more importantly, the war turbo-charges an arms race which, by definition, is very expensive – entailing as it does the challenge of reaching new technological frontiers and producing the resulting innovations at scale. Associated spending increases will be faster on the side that is catching up. In the case of hypersonic missile technology, that means the US – that is, the relevant source of demand for the rearmament investment theme.

Another such area is the modernisation of the US nuclear ‘triad’ (bombers, ground- and submarine- launched missiles) in response to Russia’s modernisation of its strategic nuclear forces since the US unilateral withdrawal from the Anti-Ballistic Missile Treaty in 2002.

Christopher Granville is managing director for EMEA and Global Political Research at GlobalData TS Lombard, a globally renowned independent economic and investment strategy research provider with a 30-year track record of actionable ideas.