Austria’s defence spending increases need to be more significant to allow major modernisation as its equipment ages, amid increasing pressures in Europe to increase expenditure following Russia’s invasion of Ukraine.

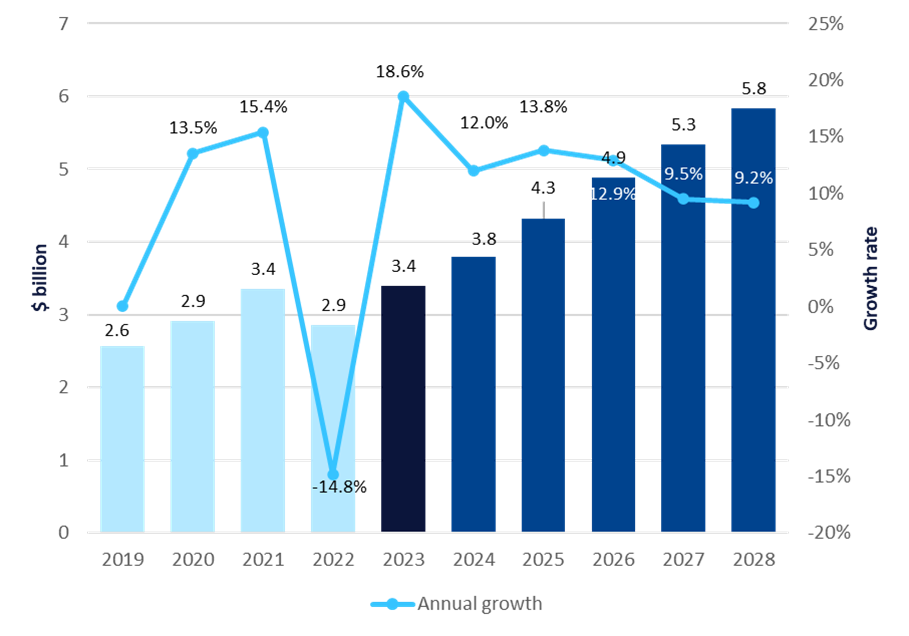

A GlobalData report on the “Austrian Defense Market 2023-2028” outlines how Austria has announced its plans to increase its defence spending in the coming years, focusing on upgrading its ageing equipment and investing in new systems. The country’s defence budget is set to rise from $3.4bn in 2023 to $5.8bn by 2028, an increase of more than 70%.

The decision to increase defence spending is partly due to the ongoing conflict in Ukraine, highlighting the need for Austria to modernise its military capabilities. The country’s tank fleet, in particular, requires an upgrade, and Austria has plans to invest in new Saab 105 jet trainers, AW169 helicopters, and Pandur 6X6 Evo armoured vehicles.

William Davies, aerospace and defence analyst at GlobalData, claimed in a briefing titled “Ukraine crisis a wake-up call for Austrian military spending“, that the procurement programmes will be costly.

“These procurement programs will cost a significant amount, around $4.9 billion over the next ten years and leave Austria little manoeuvrability in terms of new purchases but increasing the defence budget to 1% would alleviate some of this constraint, “ states Davies.

“The reason this spending is insufficient is because it provides Austria with little capabilities to modernise its military and make new acquisitions.”

Austria committed to neutrality

Despite the need for increased investment in defence, Austria remains committed to its policy of neutrality. This stance on international conflict will likely be a key political issue in the coming years as the country balances the need to modernise its military capabilities with its desire to remain neutral in international conflicts.

Like Austria, Switzerland also takes a neutral stance on international conflicts but has invested significantly more than Austria.

Davies continued: “In comparison to Switzerland, which has a similar population but spent over $8bn on defence in 2021 (or 1.14% of its GDP), more than Austria’s $3bn in the same period. This increased spending provides Switzerland with the capability to purchase new fighter jets, mortars and Patriot missiles.”

According to GlobalData analysis, spending levels will increase to 1.2% of GDP—lower than its allies but higher than historical levels, which have struggled to get above 1.0%.

Austria’s ageing equipment and need for new systems will be a significant driver and many of its systems are ageing, with out-of-service dates rapidly approaching, which will compound the need for further acquisitions.

The military fixed-wing sector is the largest segment in the Austrian defence market, valued at $102.3m in 2023 and expected to rise to $145.3m in 2028, partly down to the anticipation that Austria will procure a replacement for its Saab 105 fighter jets.

Meanwhile, the military rotorcraft sector is the second largest, valued at $48.4m in 2023 and expected to reach $71m by 2028. The move is also expected to boost the Austrian defence industry, which will deliver the new equipment and systems required to modernise the country’s military.