Türkiye’s development of its Altay main battle tank (MBT), conducted with significant assistance from South Korea, offers a prime example of the country’s defence industry positioning itself to deliver platforms into the wider international market, according to analysis by GlobalData.

The Altay MBT is based on the South Korean K2 Black Panther and heavily relies on Korean technology. The Turkish firm BMC received technological assistance from Hyundai with the development and production of initial models with the first prototype being delivered in 2016, as detailed by GlobalData defence analyst, Wilson Jones.

Compared to the K2, the Altay features a modified CN08 120mm main gun with improved stabilisers, chemical, biological, radiological, and nuclear (CBRN)-resistant armor, and a braking system that allows for rapid acceleration and deceleration to avoid anti-tank guided missiles. The T1 and T2 are described as being “extremely similar”.

The T1 was originally supposed to feature a Turkish-manufactured engine and transmission, but due to supply chain issues, it had to use a variety of German, Korean, and Ukrainian imports for these components. The T2 is the serial production that features these Turkish elements.

A future T3 model will have an uncrewed turret, and it is possible these earlier T1’s and T2’s could receive such upgrades. All variants are compatible with exterior reactive armour additions.

Jones concludes: “Türkiye’s acquisition plans of several hundred Altay’s indicate it seeks to replace foreign systems in this domain. There has also been significant foreign interest in the Altay reported from Colombia, Saudi Arabia, and Pakistan. Qatar has already purchased 400 units, and Oman is currently negotiating a deal with Türkiye.

“While the Altay is a powerful platform with strong export potential, its development history also indicates that Türkiye’s defence industry remains heavily reliant on international trade and assistance. This poses challenges to the government’s plans for full defence industry autarky.”

The Altay MBT is expected to enter service in the coming months, possible in 2025 depending on manufacturing and testing progress. It is thought that Türkiye could seek to build an initial batch of 250 Altay MBTs, with a planned production of up to 1,000 vehicles across separate 250-vehicle batches.

Türkiye’s current MBT inventory is comprised of a range of foreign platforms, including M60A1 and A3 variants, older Leopard 1 tanks, as well as 339 Leopard 2A4s acquired from KMW between 2006-2013.

In data: Türkiye’s military modernisation

Türkiye is embarking on a wide-ranging modernisation programme, although the country’s economic and political issues threaten to undermine its efforts to expand its domestic defence industry, while the erosion of an independent central banking system have limited Western investment, GlobalData stated in a 27 June release.

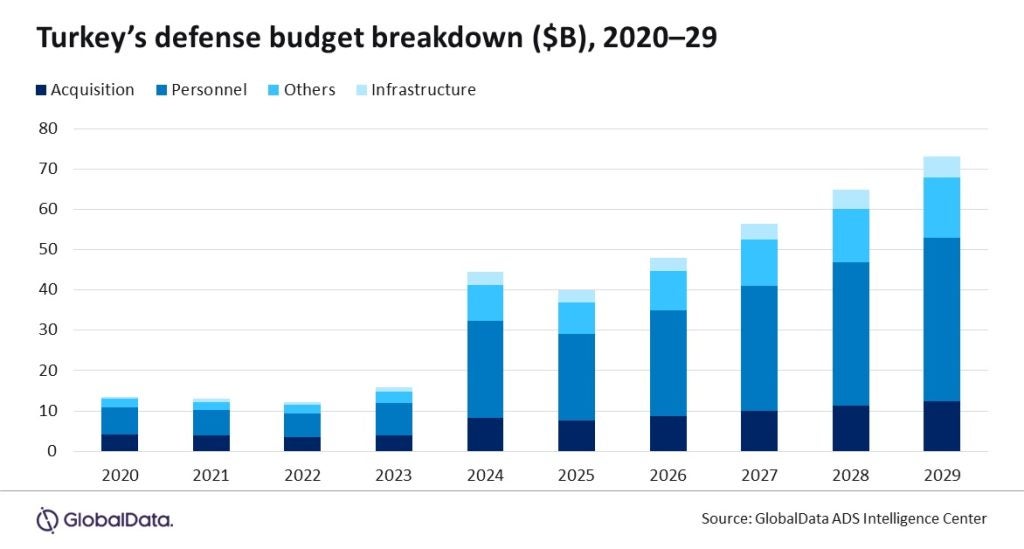

Examination of GlobalData’s report, “Turkey Defense Market 2024-2029”, reveals the country’s defence budget is set to increase significantly to $73.2bn in 2029, up from $44.5bn in 2024. In addition, the acquisition budget, which is $8.3bn in 2024, will rise to $12.5bn by 2029.

The personnel spend will increase from $24.1bn in 2024 to $40.3bn by the end of the forecast period.

Jones commented: “Türkiye is struggling with rising corruption and authoritarianism, and President Recep Tayyip Erdoğan’s rule is increasingly criticised as dictatorial. The targeting of opposition figures, independent judges, and rising corruption all contributed to the EU’s 2023 decision to halt Türkiye’s EU accession due to worsening human rights.”

Further, Jones said that economically, Türkiye has been in a “major crisis” since 2018, with the lira dropping from 6-1 to 35-1 against the US dollar. Inflation is rising, caused in part by a large government deficit and large amounts of foreign-currency denominated debt (largely held in stronger Euros and the US dollar).

“These factors disincentivise foreign investment in Türkiye, as other markets are perceived to offer strong returns without these risks and challenges to doing business,” Jones explained.