The US is the world’s largest investor and developer of electronic warfare, spending an estimated $5bn on the signal technology in 2024 so far alone, according to a new report.

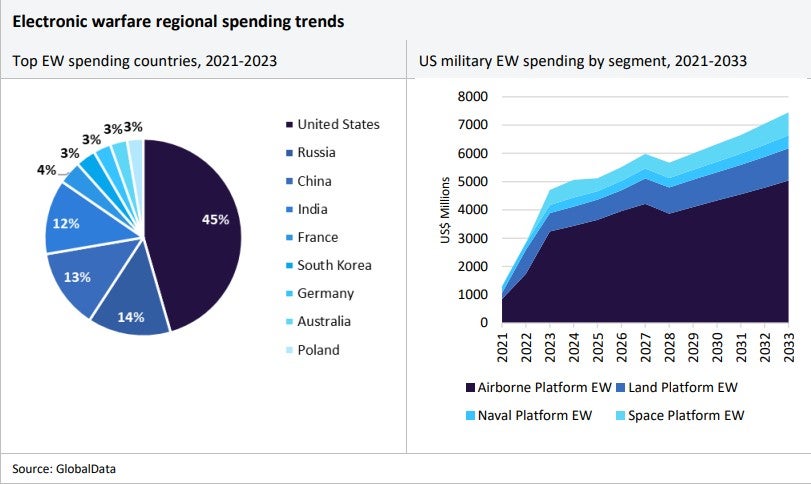

GlobalData’s Electronic Warfare report details that, between 2021 and 2023, the US military accounted for the largest share of electronic warfare spending by a significant margin – 45% of global expenditure compared to Russia’s 14% and China’s 13%.

Washington’s stranglehold on the electronic warfare market looks set to be challenged, however.

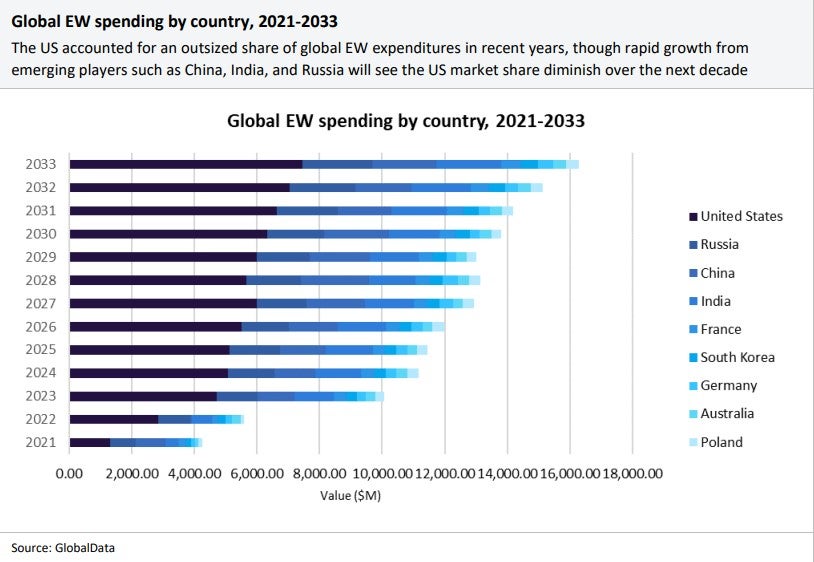

The report predicts that Russia, China and India’s share of the electronic warfare market will only increase over the next decade.

Total expenditure by the world’s nine main electronic warfare militaries will surpass $16bn by 2033, the report adds, up from more than $11bn this year.

What is electronic warfare?

Electronic warfare, or electromagnetic warfare as Nato now calls it, refers to the use of directed energy in the electromagnetic spectrum to attack or impede an enemy’s operations.

While cyberwarfare encompasses the software and data, electronic warfare involves the actual hardware and signals, usually using radio, infrared or radar signal technology.

It can be applied from air, sea, land or space to target communication, radar or other military assets.

Which militaries are leading in electronic warfare?

For now, the trailblazing US continues to enhance its electronic warfare technology across all command levels and service branches.

In the US Air Force, this includes BAE Systems’ Eagle Passive Active Warning Survivability System (EPAWSS) and Boeing’s E-7 Wedgetail (also procured by Australia, South Korea, Turkey and the UK).

The US Army has rolled out various electronic warfare systems, notably including the Modular Electromagnetic Spectrum System (MEMS), one of the PM EW and Cyber division’s newest programs aiming to counteract hostile systems looking to target US command infrastructure.

Over the past two decades, Russia’s Ministry of Defence has looked to exploit apparent complacency in the US’ electronic warfare strategies, which have focused more on counter-insurgency operations against non-state actors.

Moscow’s strategy of ‘hybrid warfare’ incorporates electronic warfare capabilities to disrupt adversarial networks on the battlefield, support conventional assault forces through SIGINT and jamming attacks, and, finally, secure captured territory against counterattacks.

Russia has used this model in Ukraine to disrupt regional civilian services, such as spoofing GPS and telecommunications. Putin has also exerted geopolitical pressure beyond the theatre of its military operations to Ukraine’s neighbours – thereby avoiding an unwanted escalation and triggering Nato’s Article 5.

China has largely mirrored Russia’s electronic warfare strategies.

As early as 2002, the People’s Liberation Army (PLA) began implementing a doctrine for information-centric warfare that centred on the electromagnetic spectrum, with then-Chinese President Hu Jintao stating that “information dominance is, in effect, electromagnetic dominance”.

In the heavily contested South China Sea, the PLA Navy has installed electronic warfare technology at bases across the Spratly Islands reefs, believed to include high-frequency-direction-finding (HFDF) for theatre-level SIGINT.

As the US, Russia, China and other emerging players continue to develop new electronic warfare systems, military attention will remain fixed on its widening use.