The US Department of Defense (DoD) has acquired the Havik virtual reality (VR) simulation training platform for the US Special Operations Command (USSOCOM) in a contract valued at $19.9m.

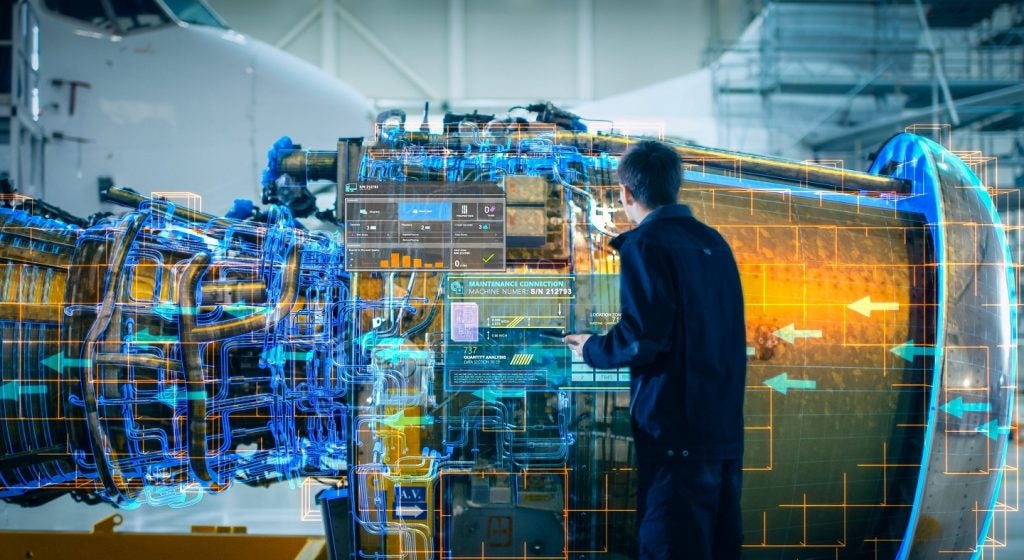

Military training and education will be one of the largest use cases of the metaverse in the defence industry, according to GlobalData intelligence.

For decades, armed forces have used simulators to train their personnel. The metaverse will provide the same benefits at a much lower price point thanks to commercial off-the-shelf (COTS) products such as Meta Quest VR headsets, HoloLens 2 headsets, and gaming PCs and peripherals.

Havik has designed its VR training system to complement the DoD’s legacy simulators. The startup provides a hardware and software system that is modular and customised to the requirement of individual units and operators.

The company’s flagship product, the ‘Havik Joint Fires Trainer’, is a self-contained VR training system. Alongside the integration of the ‘Havik Core’, the instructor station can separate from the location of its student end users, or ‘scouts’.

Havik’s immersive yet mobile training system meets the requirements of USSOCOM. As a joint force that oversees clandestine operations across the armed forces USSOCOM requires remote, immersive and interoperable capabilities. Havik delivers these three criteria – including Joint Terminal Attack Controllers to operate with military aircraft.

Small businesses such as Havik are driving innovation

As part of the DoD’s focus on integrating small businesses into the US defence industrial base; Havik won the contract under a Small Business Innovation Research Phase III award.

At the cost of maintaining considerable benefit to larger prime defence companies, smaller businesses supplying resources and subcontracting work hardly benefit in comparison.

In April 2023, the department issued its Defence Contract Finance Study findings; the first defence industry review in 35 years. The report found that “Small businesses are particularly vulnerable when it comes to having cash on hand to cover operating expenses. In general, they do not have the same opportunities to obtain working capital as their larger counterparts”.

European agencies are also contracting startups for innovative tech solutions. Discussing the rise of small business startups in the wider tech industry, Laurynas Mačiulis, the CEO and co-founder of an optical space-to-ground communications company based in Lithuania called Astrolight, emphasised that “we see that military warfare technology is really changing with what we witnessed in the war in Ukraine.

“With more and more commercial infrastructure and technology that is being used for war, all these social networks and so on… It’s important to have support from venture capital [and] from business angels to support these initiatives.”

Metaverse tech supply chain issues

GlobalData’s report on the Metaverse in Defence (2023) tells us that rising geopolitical tensions are requiring military forces and the companies that supply them to modernise all aspects of equipment and operations. “As such, no major player within the defence supply chain can ignore any metaverse value chain layer; however, specific value chain layers should be prioritised.”

Original equipment manufacturers and prime contractors must invest in the foundation and experience layers and explore the tools and user interface layers.

“Investment in the foundation layer is crucial as this layer encompasses both semiconductors and components required to manufacture advanced electronics.”

Just like in other industries, semiconductors play a crucial role in aerospace and defence, especially when armed forces worldwide are gradually gearing towards network-centric warfare. Manufacturers are fitting almost all types of modern military platforms with components and sub-systems that use semiconductor chips – none more so than interoperable agencies such as USSOCOM.

The report adds that “COTS companies can invest in all layers of the metaverse value chain. [They] have become the major suppliers to defence manufacturers and militaries alike.”

While metaverse tech companies such as Havik are driving innovation with a balance of mobility and immersive tech, we can still expect startups to be wary of the financial support needed to enter the US defence industrial base as foundational layer components remain costly and in high demand.