The effects of the most recent US assistance packages to Ukraine have begun to reverberate within the US industrial landscape, as the percentage of jobs in the aerospace and defence sector is dominated by the US.

The moves, aimed at supporting Ukraine's efforts to counter Russia's aggression, has not only solidified Washington's commitment to Ukraine's security but also catalysed a surge in domestic industry growth.

Domination of the jobs market bolstered by US donations

The recent donation by the US to Ukraine, totalling up to $200m, includes munitions for the Patriot air defence systems and High Mobility Artillery Rocket Systems. These resources, part of the $6.2bn drawdown authority allocated in June, have, like other donations, generated a ripple effect within the US defence sector.

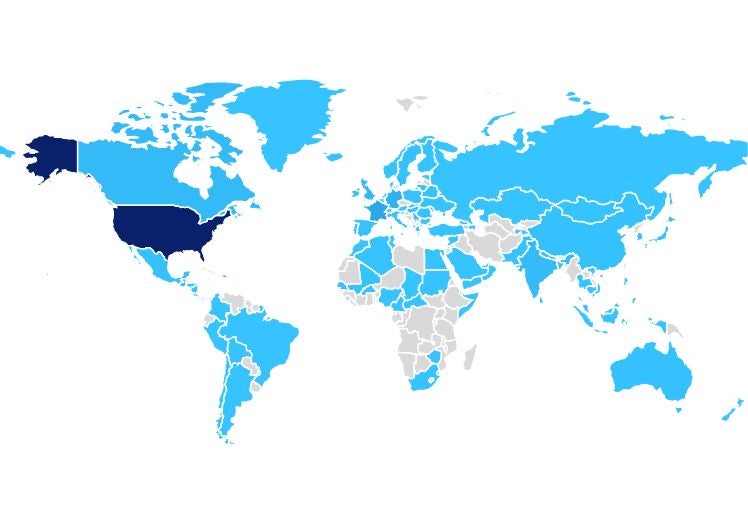

As a result, the US defence industry is shown to dominate the worldwide jobs market with GlobalData’s jobs analytics database reporting that the US has reported 60% of all worldwide aerospace and defence job hirings, reflecting the nation's hold over the aerospace and defence jobs market as it bolsters its defence capabilities and that of its allies.

The second and third highest are France with 10% and Germany with 7%.

Signs of inventory replacement and strengthening industry

With 60% of aerospace and defence jobs being within the US, it is evident that the industry is not only fulfilling immediate needs but also aiming to replace depleted inventories. This hold over recruitment shows the commitment of the US to maintain a robust and self-reliant defence ecosystem.

It also signifies the desire to replenish stocks used in supporting Ukraine's counteroffensive operations against the Russian invasion.

Tristan Sauer, aerospace, defence, and security analyst at GlobalData, provided commentary on the matter, "As NATO members and the US seek to refill stockpiles of material depleted by donations to the Ukrainian war effort, the promise of more long-term support for dwindling manufacturing capabilities has incentivised many firms including primes such as BAE Systems, Lockheed Martin and RTX to invest in their personnel to ensure they can meet emerging standards for defence industrial capacity.

This is most apparent in the North American market, with an estimated 60% of global aerospace and defense roles now being located within the US alone due to its well established domestic industrial base coupled with the US Dept. of Defense's outsized share of the global defense procurement market."

Push for defence budget growth

The ongoing conflict in Ukraine, coupled with the substantial demands of the defence industrial base, is driving the Department of Defense (DoD) to pursue further defence budget growth, according to GlobalData’s “US Defense Market 2022-2027” report.

Despite existing commitments, the US is providing significant weaponry and military aid to Ukraine, necessitating substantial funding for the sector.

With 60% of worldwide aerospace and defence jobs being within the US defence sector, attributed to the support extended to Ukraine, highlights the interconnectedness of global security and domestic industry growth. As the US industry works to replace lost inventory and strengthen its capabilities, the nation reaffirms its dedication to fostering global stability in an evolving geopolitical landscape.

Our signals coverage is powered by GlobalData’s Thematic Engine, which tags millions of data items across six alternative datasets — patents, jobs, deals, company filings, social media mentions and news — to themes, sectors and companies. These signals enhance our predictive capabilities, helping us to identify the most disruptive threats across each of the sectors we cover and the companies best placed to succeed.