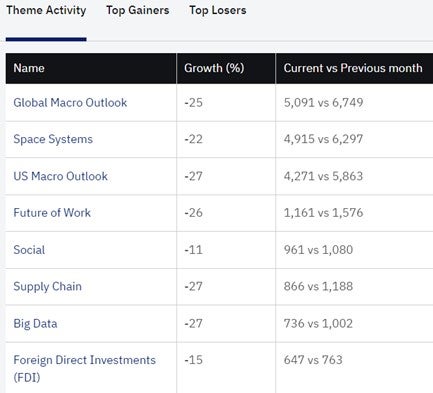

GlobalData’s theme activity analytics for jobs in aerospace and defence indicates a general decline, except for Japan’s macroeconomic outlook.

While jobs in the Future of Work have fallen by 26%; Space Systems and Supply Chain jobs by 22%; Cloud by 16%; and Electronic Warfare and 3D Printing by 14%; Japan’s Macro Outlook has seen a positive increase of 20%, with 152 jobs this month compared with 127 last month.

Why has Japan’s outlook increased amid widespread downturn?

Japan’s aerospace and defence industry has made room for growth through changes in its technology sector and strategic importance in the Pacific, where geopolitical tensions continue to fester with China.

On 26 June, the Japanese government offered to buy out JSR, a leading domestic semiconductor equipment manufacturer. The fund explained that “the tender offer is designed to enable JSR to smoothly and rapidly promote its bold, medium-to-long-term strategic investments without being bound by the short-term impact on business performance.”

At the centre of the global semiconductor market, the US and China are competing in their ‘chip war’ in order to gain the advantage in their wider geopolitical and military rivalry. Therefore, securing semiconductor material supply chains has become a military necessity, and Japan has expanded its ability in this area with this acquisition. This expansion may translate to growth in jobs in this critical defence-related sector.

Likewise, Japan’s strategic importance, alongside its allies in the Indo-Pacific, has helped job growth. On 14 August, Australia and Japan announced that efforts to strengthen their defence ties with the Japan-Australia Reciprocal Access Agreement (RAA) were coming into effect.

This military agreement provides the legal framework for greater defence co-operation between the Australian Defence Force and Japan Self-Defense Force. It is the first visiting forces agreement Japan has struck with any country outside the US.

Our signals coverage is powered by GlobalData’s Disruptor data, which tracks all major deals, patents, company filings, hiring patterns and social media buzz across our sectors. These signals help us to uncover key innovation areas in the sector and the themes that drive them. They tell us about the topics on the minds of business leaders and investors, and indicate where leading companies are focusing their investment, deal-making and R&D efforts.