Each week, Army Technology, Airforce Technology and Naval Technology’s journalists analyse data on patent filings and grants that illustrate innovation trends in our sector. These patent signals show where the leading companies are focusing their research and development investment, and why. We uncover key innovation areas in the sector and the themes that drive them.

This new, thematic patents coverage is powered by our underlying Disruptor data which tracks all major deals, patents, company filings, hiring patterns and social media buzz across our sectors.

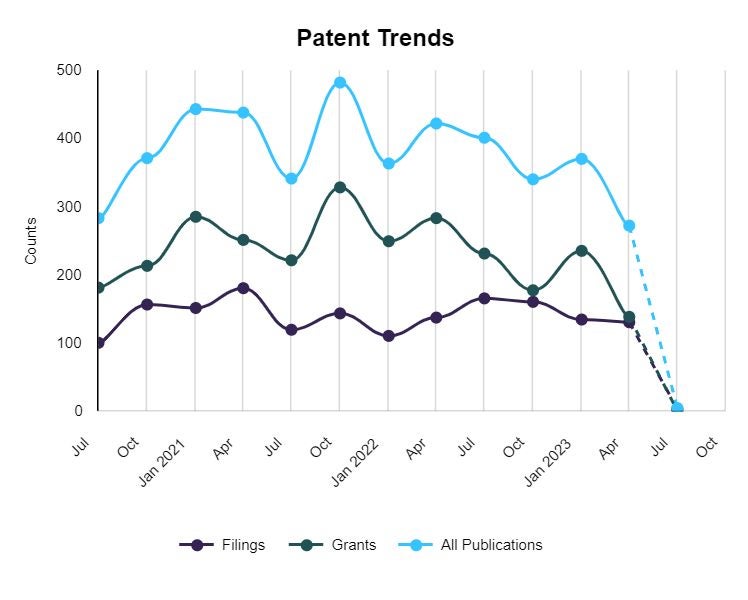

Examining the patent analytics for aerospace and defence, a distinctive trend emerges, a steady ascent followed by a subsequent decline in the simulation and training sector over the past three years.

This downward trajectory is evident as patent-led publications plummeted from 444 in Q1 2021 to 273 in Q2 2023. GlobalData's Patent Analytics for Q2 2023 underscores the lowest patent count for the defence industry's simulation and training sector since Q3 2020.

Interestingly, the imposition of Covid-19 restrictions and global economic shutdowns significantly impacted the count down to 284 in Q3 2020—nearly 200 fewer than in Q4 2021.

There was a subsequent rebound by Q2 2021, reaching 439 patents, which peaked at 483 in Q4 2021 after the widespread distribution of Covid-19 vaccines and the subsequent relaxation of restrictions worldwide. However, this peak was followed by a consistent decline in subsequent quarters, although Q2 2022 and Q1 2023 witnessed slight increases.

The declining patent count since Q4 2021 raises questions about innovation levels within the simulation and training domain, potentially indicating a recent peak or lull in progress. Influenced by the Covid-19 pandemic and the Ukraine conflict, the tumultuous economic environment may have diverted resources away from simulation and training projects, impacting funding and prioritisation.

The fluctuating data underscores businesses' instability over the past year, potentially affecting the urgency placed on simulation and training equipment. Interestingly, the focus is shifting from quantity to quality, with a rise in thin licenses for novel products and innovations in this sector.

Against US-China tensions, the patent distribution speaks volumes—China leads with 2,604 patents, while the US follows with 605 in Q2 2023. Notably, the US dedicated efforts to bolster Ukraine's defence capabilities in response to Russia's incursion, replenishing inventory and replacing lost capabilities.

GlobalData's insights highlight the top five trending themes during this period: Robotics, Electronic Warfare, Metaverse, Environment, and Artificial Intelligence.

The prevailing focus on real-life soldier simulation training is evident in the leading sectors: Simulation Training, Land Simulation and Training, and Weaponry. These sectors reflect the industry's commitment to refining training techniques and equipment for military personnel.