Given the tumultuous militarisation of Europe since Russia’s full-scale invasion of Ukraine nearly two years ago, the Organisation of Joint Armament Co-operation – often referred to by the French abbreviation ‘OCCAR’ – is seeking new participating nations in the programmes it facilitates.

Director of the organisation’s executive administration, Joachim Sucker, visited the Swedish capital Stockholm on 6 February 2024, to try to coax the Nordic country’s national armaments director Gorgen Martensson.

Sucker explained that his visit was part of an “information campaign” requested by the six main OCCAR member states – Belgium, France, Germany, Italy, Spain and the UK – approaching possible European partners to sign agreements with the organisation.

Confidence in OCCAR’s efficiency is reflected in the considerable growth of platforms that the agency has taken on in recent years: from 16 in 2022 to 25 in 2024. Alongside that, the agency’s operational budget also increased by more than €1bn ($1.08bn).

OCCAR’s growing portfolio includes the Boxer armoured vehicle, of which it has delivered 688 units; the A400M transport aircraft, having delivered 120 units by the end of last year; the FREMM multi-mission frigates, delivering 16 out of 18 ships; and FSAF-PAAMS surface-to-air missile defence systems, for which it made its 14th contract amendment this week.

Currently, Sweden is one of ten ‘non-member participating states’ within the OCCAR structure. This designation contrasts with the six aforementioned ‘member states’. A third classification includes nations with ‘observer’ status including Australia, Japan and Brazil.

Sucker acknowledged OCCAR’s existing co-operation with Sweden, although he hopes that this engagement will take a step further in signing another framework and security agreement.

At the moment, the Swedish defence prime Saab participates in OCCAR’s REACT project, wherein it is designing an airborne electronic attack capability alongside Indra, Elettronica and Hensoldt.

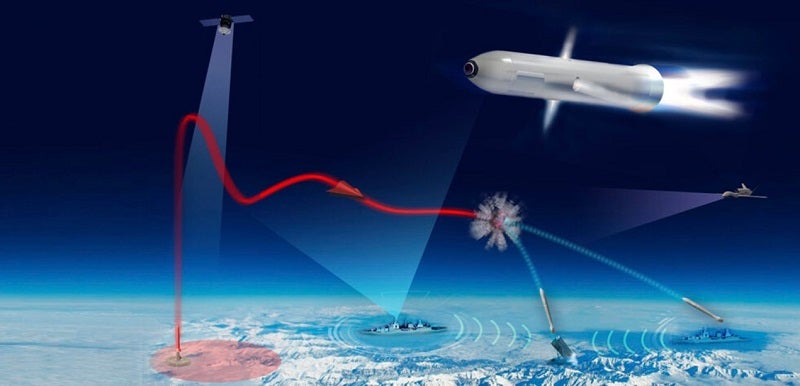

Likewise, the Swedish arm of the space systems supplier Beyond Gravity also participates in one of OCCAR’s most promising programmes, such as its attempt to produce an endo-atmospheric (within Earth’s atmosphere) hypersonic defence interceptor (HYDEF).

What can OCCAR offer Sweden?

The Swedish defence market is highly indigenous with global industry players such as Saab producing a range of globally coveted systems. According to intelligence from GlobalData, a leading data analytics company, the country’s fastest growing segments are fixed-wing aircraft, missiles and missile defence systems, as well as naval vessels.

As far as OCCAR is concerned, Sweden’s defence output in these sectors will provide greater enhancement of some of its programmes.

However, judging from GlobalData’s account of the nation’s equipment list certain OCCAR programmes may support the Swedish Armed Forces in replacing some of its enduring systems, particularly in the land domain.

Currently, the Swedish Armed Forces are upgrading or replacing existing platforms with modern, more capable variants. The air force will receive 70 new Gripen fighter aircraft, and the Swedish navy is replacing older models of submarine with the new Blekinge-class and modernising one of the Gotland-class to increase the fleet size from four to five.

Other programmes include sensor upgrades for the S100D airborne command and surveillance system, and a mid-life upgrade (MLU) for the army’s Patria armoured fighting vehicles.

Why target the Nordic region?

“OCCAR is a very useful office for collaborating European defence projects, and in current times I’m sure they would be very keen to deepen ties with new Nordic Nato allies, both Sweden and Finland,” GlobalData Defence Analyst James Marques indicated.

“Hungary is holding up Sweden’s membership still and perhaps they planned to do this after Sweden’s accession, but there is a growing sense of urgency in European defence given shaky situation in Ukraine and possibility of US fully losing the plot,” he added.

“A history of neutrality means Sweden and Finland are experienced and self-reliant manufacturers, who likely have the knowledge and skill base to assist in scaling rearmament, perhaps basic items such as shells, but also technical know-how in a lot of growing European programmes.”