Each week, Army Technology, Airforce Technology and Naval Technology journalists pick out insights from company filings that highlight sentiments in our sector. These filings signals are based on GlobalData’s analysis of earnings statements, call transcripts, investor presentations and sustainability reports. They tell us about key topics on the minds of business leaders and investors, and the themes driving a company’s activities.

This new, thematic filings coverage is powered by our underlying Disruptor data which tracks all major deals, patents, company filings, hiring patterns and social media buzz across our sectors.

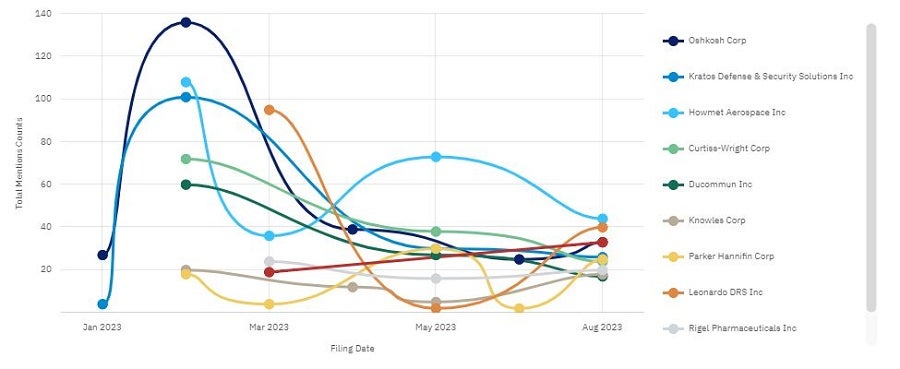

Although two prominent aerospace companies – Howmet and Leonardo – remain ahead in GlobalData’s filer company trends for 2023, they only lead by a short margin as land domain companies rise to the occasion.

GlobalData filings analytics tell us that Howmet Aerospace has consistently been spoken about the most this month, with 108 mentions in February. At the start of August, this had declined to 44, while the company’s lowest count fell to 36 in March. Similarly, Leonardo had reached as high as 95 mentions, which fell to 2 in May.

Land domain companies – specifically Oshkosh Corporation, a Wisconsin-based military vehicles company – has risen several times this year, now holding pride of place with 33 mentions as the third most discussed company in the aerospace and defence industry for August. Although, it had reached the highest amount of mentions in the whole industry in February at 136 mentions.

The decline in aerospace company mentions is an intriguing divergence from GlobalData’s patent analysis at the end of July, which indicated a growth in aerospace patents.

This analysis suggested that Aerospace remained the most common sector for patents-related publications in the defence industry compared to land and maritime with 230,784 filings and grants over the past three years, more than four times the combined total of the other two traditional domains at 25,371 and 26,844 respectively.

Ukraine and Taiwan – aerospace undelivered

Oshkosh Defense, an Oshkosh Corporation subsidiary, has recently rebound from its $8.66bn loss of the Joint Light Tactical Vehicles (JLTV) A2 follow-on production contract to the US Army, for which the company’s protest was denied by the US Government Accountability Office in June, with a series of contracts to the US Army for other vehicles.

The company has ramped up production of JLTV A1s for the US Department of Defense (DoD) and its allies and partners, including Romania and Lithuania to name two, as well as its Family of Military Tactical Vehicles for the US Army.

As well as this, the DoD has recently announced a military assistance package to Taiwan worth $345m on 28 July. According to GlobalData intelligence, Taiwan currently operates BAE Systems’ armoured personnel carriers, which were procured in 2005. Given the rise of mentions for BAE Systems from 19 in March to 33 in August, it would be reasonable to believe that the company may provide more interoperable land systems for Taiwan under this package.

While Ukraine is stuck in a slow counter-offensive against invading Russian forces in the south and east of the country, industry commentators are calling for aerial superiority to gain the upper hand. But while Ukrainian F-16 pilots are still in the process of being trained on the sophisticated western aircraft by the US and its allies in Europe, and given the poor infrastructure and airstrips in Ukraine, it is not surprising that the aerospace sector is experiencing some decline.