The head of the European Commission, Ursula von der Leyen, has stated that countries of the European Union will produce one million artillery shells per year from 2024, as the continent’s defence industries orientate towards more active production line in the face of Russia aggression in Ukraine.

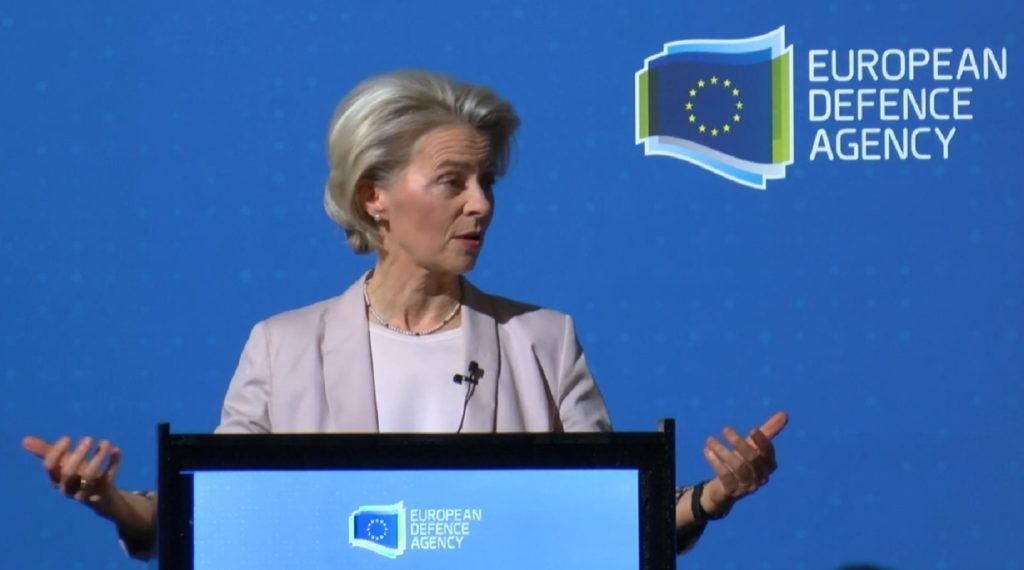

Speaking to members of the European Defence Agency (EDA) at the end of November, von der Leyen claimed countries of the European Union – referred to in the speech as “Europe” – had produced or delivered 480,000 rounds of artillery ammunition to Ukraine.

“This would have been unimaginable just two years ago. And it already marks a massive step forward for our defence cooperation,” von der Leyen stated.

However, this claimed provision falls short of the pledge to send one million 155mm artillery shells to Ukraine by March 2024.

According to a 6 December report by Reuters, EU states have placed orders for only 60,000 artillery shells under a scheme to provide Ukraine with one million rounds of ammunition by Spring 2024.

By contrast, the US alone has provided two million rounds of 155mm ammunition, 800,000 105mm shells, 10,000 203mm shells, 200,000 152mm rounds, 40,000 130mm shells, and 40,000 130mm shells, along with 100,000 guided and unguided rockets and more than 400,000 mortar rounds from 60-120mm calibre, according to Department of Defense figures.

This amounts to more than 3.5 million rounds of artillery and mortar ammunition since February 2022. For small arms rifles and machines guns, the US have provided 400 million rounds to Ukraine.

Ukraine’s usage of artillery ammunition has not been officially disclosed but is understood to run into several thousand rounds per day.

Western countries such as the UK, US, France, Germany, Sweden, and others have also donated 155mm-capable artillery systems such as the AS90 and M109 Paladin howitzers, while Ukraine also retains a large stock of Soviet-era artillery, despite war attrition.

The spooling up of European Union member states’ defence industry will be critical to the fate of Ukraine, which is dependent on outside assistance to combat Russian forces.

A likely concerning factor for Ukraine will be the ongoing political struggles in the United States, its largest military supporter, which was recently revealed to be running short of Presidential Drawdown Authority funding being used to sustain military assistance to Kyiv.

In addition, the US Congress moved to block a supplementary budget package that included a $44bn commitment to Ukraine due to political infighting, raising the prospect of a US Government shutdown in early 2024. The looming US election, with potential Republican candidate and former president Donald Trump not keen to sustain US support of Ukraine, could have decisive impact on the outcome of the Ukraine-Russia war.

It far from certain that EU states would be unable to bridge the gap should the US reduce or withdraw its willingness or ability to support Ukraine, despite the bold words from EU politicians such as von der Leyen.

Wilson Jones, defence analyst at GlobalData, said the US is providing “the majority” of ammunition to Ukraine, with EU states suffering from “fairly serious” supply chain issues. It would be “highly unlikely” that the EU could step in to fill the ammunition void, Jones said.

“On several occasions, their response to artillery ammunition shortfalls has been to buy shells from American firms, rather than increase domestic production. EU plans to increase production haven't reached anything close to their targets,” Jones told Army Technology.

Pushing for a European Defence Union

During the EDA speech, von der Leyen outlined the provision of EU support to Ukraine so far, amounting to €5.6bn ($6.4bn), and the delivery of armoured vehicles, helicopters, air defnece systems, and artillery ammunition. One element of this process has been the development of the European defence industry reinforcement through common procurement act (EDIRPA), which was signed and published on 26 October this year.

“Now, for the first time ever, we are mobilising Europe's defence industry to sustain a war effort. The European Defence Fund has been complemented by EDIRPA. And it has led to ASAP, the Act in Support of Ammunition Production,” von der Leyen said.

However, von der Leyen stated in her speech to the EDA that all these efforts were “not enough”, and that greater defence industrial support would have to be provided to Ukraine.

“The war in Ukraine is consuming more hardware than any other war in recent history. Russia has fired ten million shells in a year, [while] Ukraine consumes 10,000 drones per month. The reality is that we did not have sufficient weapons and ammunition available. No large stocks, and a lack of spare capacity,” von der said.

Continuing, von der Leyen stated that while EU member states’ national defence budget are rising, “too much” was being spent in isolated single-country programmes, rather than combining requirements into one common design, as envisaged through the PESCO structure. According to von der Leyen, collaborative defence spending between EU states was below 20%, some distance from the 35% target.

In addition, too much of European countries’ defence spending was being done so outside of the continent. “Latest figures show that additional funds are in large majority spent outside the European Union. We are predominantly buying alone and buying abroad,” von der Leyen said.

“The next chapter is a fully fledged European Defence Union. So that Europe can finally take strategic responsibility for its own future.”