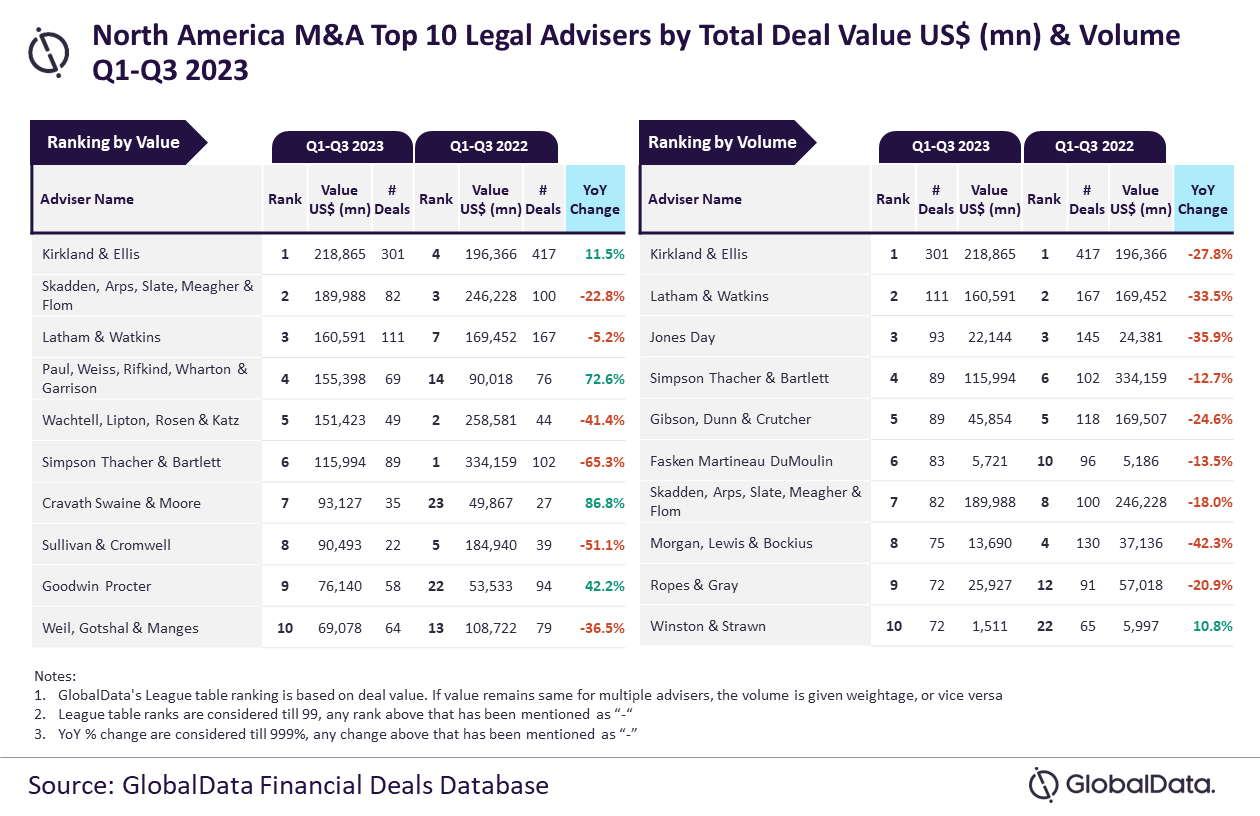

Kirkland & Ellis was the top M&A legal adviser in North America in Q1-Q3 2023, according to GlobalData’s ranking of leading M&A advisers.

Analysis by GlobalData reveals that Kirkland & Ellis achieved the leading position by advising on 301 deals worth $218.9bn.

“Kirkland & Ellis was the clear winner both in terms of deal volume and value, outpacing its peers by a significant margin. It was the only adviser to have advised on more than 300 deals during Q1-Q3 2023,” said GlobalData lead analyst Aurojyoti Bose.

“Moreover, Kirkland & Ellis was also the only firm to surpass $200bn in total deal value as it was involved in several high-value transactions. It advised on 48 billion-dollar deals [valued at or above $1bn] during Q1-Q3 2023, which also included five mega deals valued more than $10bn.”

An analysis of GlobalData’s Financial Deals Database reveals that Latham & Watkins came second in terms of volume with 111 deals, followed by Jones Day with 93 deals, Simpson Thacher & Bartlett with 89 and Gibson, Dunn & Crutcher also with 89 deals.

Measured by number of transactions, Skadden, Arps, Slate, Meagher & Flom came by advising on $190bn worth of deals, followed by Latham & Watkins with $160.6bn, Paul, Weiss, Rifkind, Wharton & Garrison with $155.4bn, and Wachtell, Lipton, Rosen & Katz with $151.4bn.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions of deals from leading advisers.