The surge in the acquisition of artillery systems by militaries in North America, Europe, and the Asia-Pacific regions appears to represent the initial stages of earlier forecast growth in the sector, primarily in the self-propelled and multiple-launch rocket system (MLRS) segments.

According to 2023 intelligence from GlobalData, the demand for self-propelled artillery systems was forecast to drive growth in the long—and medium-range fires market, which currently accounts for around 40% of the sector.

Since then, several countries have made headlines with regular orders and brought some newly delivered capabilities online.

In Q4 2023, the UK took delivery of the first of 14 Archer 155mm self-propelled artillery systems from Sweden, a measure intended to bridge a capability gap following its donation of dozens of its AS-90 tracked 155mm systems to Ukraine to aid the country in its war against Russia. The UK’s Archers have since been fired for the first time in trials.

Poland, meanwhile, continued to receive K9 ‘Thunder’ 155mm tracked self-propelled artillery systems from Hanwha as part of a wider defence deal with South Korea, which required the provision of multiple platforms, including main battle tanks.

In 2023, Poland signed a further $2.6bn deal with South Korea to provide more than 150 K9 platforms.

In January 2024, the US Government placed an order with BAE Systems to purchase additional M109A7 Paladin self-propelled howitzers and M992A3 ammunition carriers for $418m. Having restarted full-rate production in June 2022, the US Army has continued to modify the contract to add scope to its growing inventory, providing an additional $64m in funds to the manufacturer in November 2023.

BAE Systems received the initial contract for M109A7 production in 2017, with the latest order bringing the total contract value to $2.5bn.

Asia-Pacific countries such as Japan are investing billions of dollars in the procurement of stand-off, long-range attack platforms. These platforms are expected to play a significant role in any conflict in the region as militaries look to diversify and distribute firepower capabilities.

Global artillery demand to reach $16.1bn by 2033

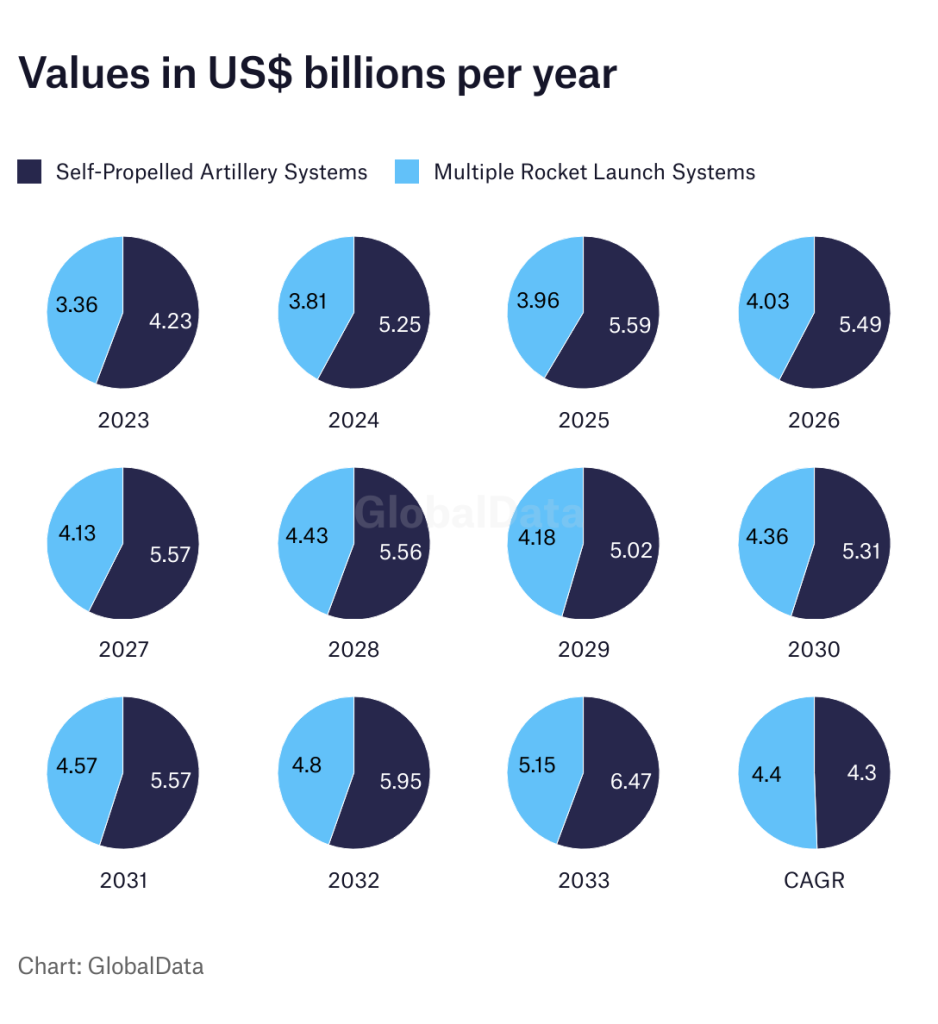

In its Global Artillery Systems Market Forecast 2023-2033 report, GlobalData forecasted that the global artillery systems market, valued at $10.8bn in 2023, was projected to grow at a compound annual growth rate of 4.1% over the forecast period.

The artillery market was expected to reach $16.1bn by 2033 and cumulatively value $150.1bn over the forecast period. It consists of six categories: self-propelled artillery systems, towed artillery systems, mortar systems, multiple rocket launch systems (MRLS), naval guns, and close-in weapon systems (CIWS).

The self-propelled artillery category dominates the sector, accounting for a 40% share, followed by the MLRS segment, which has a 31.2% share. Among geographic segments, Asia-Pacific is projected to lead the sector with a share of 42.2%, followed by Europe and North America, which have shares of 36.9% and 8.3%, respectively.

The growth rate of self-propelled artillery and MLRS systems (at a CAGR of 4.3% and 4.4%, respectively) is steeper than that of towed artillery systems. This indicates that while a sizeable market remains for towed capabilities, the mobility provided by self-propelled alternatives and the operational and lethal range of MLRS platforms make them a more attractive proposition for militaries on the modern battlefield.

Additional reporting from John Hill.