The global UGV market is forecasted to demonstrate decent growth over the next decade, although the platforms are less influential than their ubiquitous aerial cousins. Gordon Arthur reports.

Uncrewed ground vehicles (UGV) have been around a long time, but their somewhat limited use on battlefields has seen them lagging behind uncrewed aerial vehicles (UAV) in terms of the limelight and utility.

This is clearly demonstrated in the ongoing Russian invasion of Ukraine. While UAVs like the Turkish-built Bayraktar TB2 are proving deadly, very few UGVs can be seen. Russia has been using the T-90-based Prokhod-1 robotic mine clearance system for route clearance in Ukraine, as well as Kobra and Uran-6 UGVs, although this has tended to be only in safer rear areas.

Market growth areas

According to GlobalData, the global uncrewed ground vehicle (UGV) market is valued at $476m in 2022 and will grow at a compound annual growth rate (CAGR) of 4.4% to reach a value of $732m by 2032. The cumulative market of the global military UGV market is anticipated to be valued at $6.9bn over the forecast period.

Over the forecast period, the demand for military UGVs is anticipated to be witnessed most prominently in the North American and European markets, especially in countries such as the US, Russia, France, Germany, and the UK.

The North America region itself, supported by the large-scale investments from the US, is expected to maintain its leading position globally, exhibiting a steady pace of growth over the forecast period with a CAGR of 5.1%.

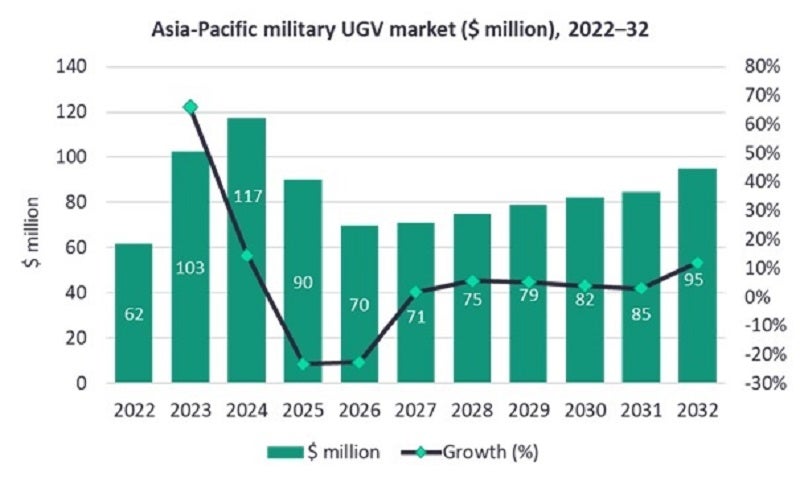

Meanwhile, the Asia-Pacific region will hold the third largest position globally with a CAGR of 4.4% over the forecast period, primarily driven by the procurement strategies adopted by key economies in the region. Countries such as China, India, Australia, and South Korea have been increasing the deployment of advanced UGVs with their armed forces.

Danger close

Two main uses for UGVs in recent decades, as illustrated in Ukraine, have been explosive ordnance disposal (EOD) robots and mine-clearing devices.

Global Defence Technology asked Kelvin Wong, a Singapore-based independent defence technology analyst, about this. He responded: “At the current state of development, UGVs appear to excel in supportive roles such as EOD and logistics, where constant human interaction is not required and where the mission parameters are more limited in scope.”

Indeed, the mantra is that uncrewed systems are ideal for dirty, dangerous and dreary work. Mine-clearing is certainly dangerous, and solutions such as Pearson Engineering’s optionally manned Minewolf minefield clearance vehicle exist.

However, technical challenges still need to be overcome before uncrewed detection systems become more widely used in mine clearance and counter-improvised explosive device tasks. They must be able to search large areas with minimal false alarms, and with the accuracy of skilled operators. While militaries would like to deploy nimble multipurpose vehicles around battlefields, they must overcome natural and manmade obstacles such as minefields.

Teledyne FLIR is a major manufacturer of robotic systems, and in 2021 it received a $70m order for nearly 600 Centaur medium-sized robots under the US Army’s Man Transportable Robot System Increment II programme, bringing total deliveries to all four US military services to some 1,900 Centaurs. A further contract was awarded in mid-2022, highlighting the large scale of many US programmes.

Teledyne FLIR also makes the 166kg Kobra for the US Army’s Common Robotic System – Heavy programme. Importantly, robots are growing in autonomy, target mapping and the ability to work as cross-domain systems. For example, Teledyne FLIR’s R&D has seen an R80D SkyRaider quadrotor UAV flying over an airfield to detect unexploded ordnance, with relevant data then relayed to a UGV for clearance.

Technical challenges

Wong noted: “UAVs have clearly become ubiquitous, while their land counterparts have not really moved beyond those very limited roles other than small-scale trials and concept development.”

So why are UGVs lagging behind their aerial cousins?

Wong explained: “It could be due to several ongoing challenges like technology limitations, but also due to a lack of understanding and trust regarding such vehicles that likely operate in close proximity to troops. For example, how does a soldier interact with uncrewed vehicles – particularly armed types – in the heat of battle?

“Does a particular UGV possess high levels of autonomy so they easily understand simple visual or verbal signals, or is it able to react appropriately to unanticipated situations? Would ‘babysitting’ a UGV further increase the cognitive burden on already mentally and physically taxed operators in the field?”

Wong pointed out that “many of these questions appear to be far from being answered, given the myriad variety of trials and concept of operations development exercises across the world. In contrast, UAVs have been readily used in both peacetime and conflict during this time.”

Apart from the human trust factor, what technological challenges are holding back UGVs? Wong summarised: “Despite advancements in enabling technologies such as autonomy, machine vision and platform mobility, challenges in obstacle avoidance and clearance – particularly in challenging cross-country and forested terrain – nevertheless remain. This is especially so for land combat operations that demand uninterrupted and uncompromised capability lest it result in mission failure and risk to soldiers’ lives, and therefore sets a high bar for reliability.

“Moreover, many UGVs are effectively tele-operated despite being marketed as ‘highly autonomous’, given that an operator is typically controlling it to various degrees. As a result, the lag between an operator – and his/her skills (or lack thereof) – and the vehicle could result in unfavourable outcomes in high-stress or challenging tactical situations.”

Wong listed another obstacle too. “The fielding of UGVs potentially adds to the bandwidth stress of modern combat operations, necessitating a wide-area secure network before these vehicles can effectively be commanded. As such, there’s always a real risk of communications/data link failure between the operator and vehicle, especially in cluttered terrain or in electromagnetically challenged environments (which literally describes the modern battlefield).”

Programmes to watch

One UGV that is making waves stems from Estonia. Wong stated: “Despite being a comparatively smaller country, Estonia has clearly captured significant mindshare globally with its tracked THeMIS, which combines a high degree of modularity with a robust tracked platform, as well as its combat-oriented bigger brother the Type X.”

This year, its maker Milrem Robotics delivered one THeMIS to a Ukrainian charity organisation for casevac and resupply missions. To date, 16 countries have acquired the optionally armed THeMIS, half of which are NATO countries. It also forms the foundation of the Integrated Modular Unmanned Ground System (iMUGS) scalable UGV family being developed by a consortium of European companies.

Asia-Pacific is a hotbed of UGV development too. As with its bewildering UAV industry, China regularly rolls out interesting UGV concepts, one example that Wong highlighted being the AAV7-sized Marine Lizard amphibious UGV. However, apart from concepts routinely showcased at exhibitions – like Norinco’s 12t VU-T10 tracked combat UGV armed with a 30mm cannon, coaxial machine gun and twin antitank missiles that appeared in November’s Zhuhai Air Show – UGVs in Chinese military service remain more elusive.

Wong declared South Korea as another country to watch. Hanwha Defense’s 2t Arion-SMET was recently selected for US Army trials. This 6×6 UGV, powered by lithium-ion batteries and with 550kg payload capacity, is designed to support platoon-level operations.

Hanwha Defense also developed the 6×6 Unmanned Surveillance Vehicle. Dronebot Warrior, a specialist Republic of Korea Army unit dedicated to uncrewed technologies, completed field trials of the 2t UGV in February 2021.

Despite advancements in enabling technologies such as autonomy, machine vision and platform mobility, challenges in obstacle avoidance and clearance – particularly in challenging cross-country and forested terrain – nevertheless remain

Kelvin Wong, defence analyst

Meanwhile, arch-rival Hyundai Rotem was awarded a $3.6m contract in November 2020 to build two 6×6 Multipurpose Unmanned Ground Vehicles (MUGV) for evaluations. These MUGVs, based on the HR-Sherpa, were handed over in July 2021 for six months of testing.

The Australian Army has interesting programmes too, with BAE Systems Australia converting 20 M113AS4 armoured personnel carriers into optionally crewed combat vehicles. These vehicles operate autonomously but with a human in the decision-making loop, their goal being performance of reconnaissance and logistics missions.

Another Australian project is seeing modification of army MAN 4×4 trucks so they can travel in leader-follower convoys. The idea is to maximise the operational efficiency of the truck fleet by removing operators, drivers and commanders from following vehicles. In this way, the human workforce can focus on more difficult or meaningful tasks.

The Atlantic pillars

The UK has put its experimental eggs in the Robotic Platoon Vehicles basket. The UK procured four Mission Master 8×8 vehicles from Rheinmetall Canada in 2020, another four in 2021 and, under the final Spiral 3 phase, a further seven Mission Master SP vehicle in January 2022 (four in ISTAR configuration and three in cargo guise).

The US Army has several foci – the Optionally Manned Fighting Vehicle (OMFV), Robotic Combat Vehicle (RCV) and Small Multipurpose Equipment Transport (S-MET). The former will be an infantry fighting vehicle to replace the M2/M3 Bradley.

Following a draft RfP issued in December 2020, the five OMFV bidders General Dynamics Land Systems (GDLS), BAE Systems, American Rheinmetall Defense, Oshkosh Defense and Point Blank Enterprises were awarded 15-month concept design contracts. Three will be selected in mid-2023 to proceed with prototypes.

Regarding the RCV programme, three UGV variants are envisaged to provide situational awareness and deliver lethality whilst reducing risk to formations. Family members include the Light (RCV-L), Medium (RCV-M) and Heavy.

The US Army will launch an open competition for the RCV-L in FY2023, with $698m set aside over the coming five years. QinetiQ North America was selected in 2020 to provide a surrogate prototype, as the US Army conducts three spiral test cycles till FY2025. RCV-L vendors will then be selected to provide full-system prototypes.

Meanwhile, a Textron, Howe & Howe and FLIR team provided an RCV-M prototype, the tracked Ripsaw M5 equipped with a 30mm cannon. Based on its M5 experience, Textron Systems is also aiming its Ripsaw M3 at RCV-L.

The US Army is additionally pursuing the S-MET for dismounted soldiers and small units. GDLS, following a 2020 contract, recently delivered an initial tranche of 16 of 624 S-MET vehicles. This 8×8 “robotic mule” has a hybrid-electric powertrain. Under S-MET Increment 2, the army may require 2,200 vehicles with various modular mission payloads.

Work to be done

The aforementioned US programmes underscore where UGVs are currently at, in terms of marketability and system capability. They promise much and thousands could eventually be used in multiple applications.

Developments in technologies such as artificial intelligence, machine learning, and advanced navigation systems is helping to drive growth in the UGV market, enabling ‘smart’ platforms that will be able to undertake a greater variety of operations. However, the technology, human trust and concepts of operation still need considerable honing. The UGV sector and the platforms have come a long way, but there is still some distance left to travel before both reach a market and capability destination as influential as their airborne counterparts.