The aerospace and defense industry continues to be a hotbed of patent innovation. Activity is driven by automation, environmental sustainability, and operational efficiency, and the growing importance of technologies such as artificial intelligence (AI), Internet of Things (IoT), drones, and satellites. In the last three years alone, there have been over 84,000 patents filed and granted in the aerospace and defense industry, according to GlobalData’s report on Innovation in defense: active vibration control. Buy the report here.

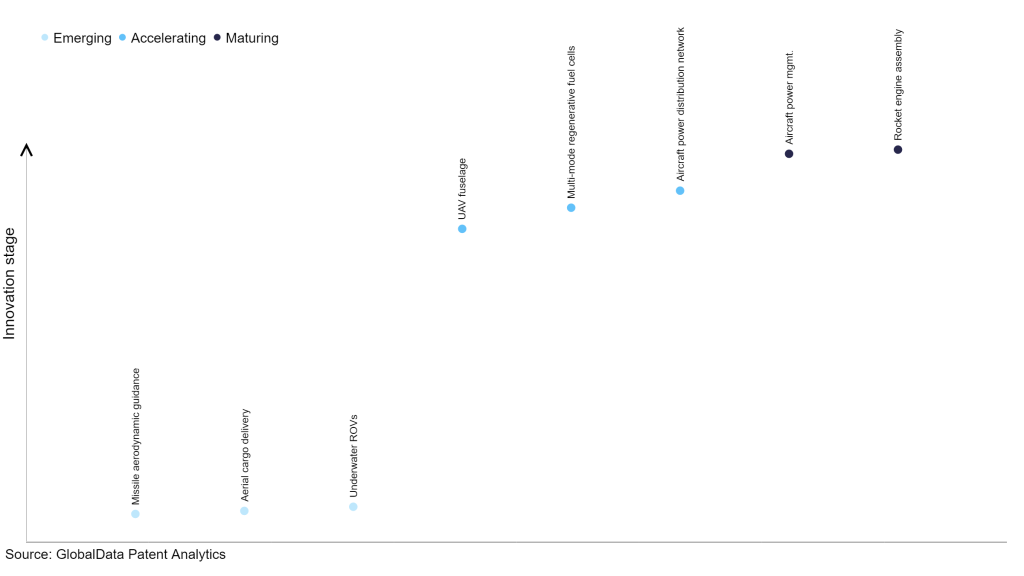

However, not all innovations are equal and nor do they follow a constant upward trend. Instead, their evolution takes the form of an S-shaped curve that reflects their typical lifecycle from early emergence to accelerating adoption, before finally stabilizing and reaching maturity.

Identifying where a particular innovation is on this journey, especially those that are in the emerging and accelerating stages, is essential for understanding their current level of adoption and the likely future trajectory and impact they will have.

110 innovations will shape the aerospace and defense industry

According to GlobalData’s Technology Foresights, which plots the S-curve for the aerospace and defense industry using innovation intensity models built on over 260,000 patents, there are 110 innovation areas that will shape the future of the industry.

Within the emerging innovation stage, missile aerodynamic guidance, aerial cargo delivery, and underwater ROVs are disruptive technologies that are in the early stages of application and should be tracked closely. UAV fuselage, multi-mode regenerative fuel cells and aircraft power distribution network are some of the accelerating innovation areas, where adoption has been steadily increasing. Among maturing innovation areas are aircraft power management and rocket engine assembly, which are now well established in the industry.

Innovation S-curve for the aerospace and defense industry

Active vibration control is a key innovation area in aerospace and defense

Active vibration control refers to the use of systems and methods to reduce or mitigate vibrations in various equipment or structures. This is achieved by sensing the vibrations and then applying corrective measures, such as damping or counteracting forces, to minimize or eliminate the vibrations. Active vibration control systems typically consist of sensors, actuators, and a control algorithm that processes the sensor data and generates appropriate commands for the actuators. These systems are used in a wide range of applications, including aircraft, rotorcraft, and other structures, to improve performance, stability, and comfort.

GlobalData’s analysis also uncovers the companies at the forefront of each innovation area and assesses the potential reach and impact of their patenting activity across different applications and geographies. According to GlobalData, there are 35+ companies, spanning technology vendors, established aerospace and defense companies, and up-and-coming start-ups engaged in the development and application of active vibration control.

Key players in active vibration control – a disruptive innovation in the aerospace and defense industry

‘Application diversity’ measures the number of applications identified for each patent. It broadly splits companies into either ‘niche’ or ‘diversified’ innovators.

‘Geographic reach’ refers to the number of countries each patent is registered in. It reflects the breadth of geographic application intended, ranging from ‘global’ to ‘local’.

Patent volumes related to active vibration control

| Company | Total patents (2021 - 2023) | Premium intelligence on the world's largest companies |

| Karem Aircraft | 4 | Unlock Company Profile |

| Eurocopter Deutschland Gesellschaft Mit Beschränkter Haftung | 16 | Unlock Company Profile |

| Lockheed Martin | 100 | Unlock Company Profile |

| National Aeronautics and Space Administration | 2 | Unlock Company Profile |

| Moog | 10 | Unlock Company Profile |

| Parker Hannifin | 7 | Unlock Company Profile |

| General Electric | 8 | Unlock Company Profile |

| U.S. Department of Defence | 4 | Unlock Company Profile |

| REHAU Automotive | 1 | Unlock Company Profile |

| Leonardo | 36 | Unlock Company Profile |

| Raytheon Technologies | 67 | Unlock Company Profile |

| Teledyne Technologies | 6 | Unlock Company Profile |

| Japan Aerospace Exploration Agency | 4 | Unlock Company Profile |

| TransUnion | 2 | Unlock Company Profile |

| Textron | 136 | Unlock Company Profile |

| Amazon.com | 1 | Unlock Company Profile |

| Boeing | 50 | Unlock Company Profile |

| Airbus | 79 | Unlock Company Profile |

| IBM | 4 | Unlock Company Profile |

| Deutsches Zentrum fur Luft- und Raumfahrt | 16 | Unlock Company Profile |

| Mitsubishi Heavy Industries | 3 | Unlock Company Profile |

| CARTER AVIATION TECHNOLOGIES | 2 | Unlock Company Profile |

| Centre National d'Études Spatiales (CNES) | 3 | Unlock Company Profile |

| EADS Deutschland | 17 | Unlock Company Profile |

| Kitty Hawk | 5 | Unlock Company Profile |

| Skyworks Global | 9 | Unlock Company Profile |

| Toolsgroup | 21 | Unlock Company Profile |

| Flybotix | 6 | Unlock Company Profile |

| Zeppelin-Stiftung | 14 | Unlock Company Profile |

| UpriseVSI | 19 | Unlock Company Profile |

| Vimaan Robotics | 4 | Unlock Company Profile |

Source: GlobalData Patent Analytics

Textron is one of the leading patent filers in active vibration control. The company has filed patents related to reconfigurable rotor blades, independent blade control system with rotary blade actuator, apparatus for improved vibration isolation, and vibration-attenuating hard-mounted pylon.

Textron's vibration isolation technologies, previously employed in Bell helicopters, deliver markedly improved performance, reducing harmonic vibration by 90% to 99.94%, all within a lighter and more cost-effective system. Notably, these technologies have minimal power needs and offer considerably stiffer mounting and are easily integrated into existing products of manufacturers.

Other significant patent filers in the active vibration control space include Lockheed Martin, Airbus, and RTX.

In terms of application diversity, Textron, Lockheed Martin, and RTX are some of the leading innovators. By means of geographic reach, some of the leading patent filers include Leonardo, Toolsgroup, and Moog.

To further understand the key themes and technologies disrupting the aerospace and defense industry, access GlobalData’s latest thematic research report on Aerospace & Defense.

Data Insights

From

The gold standard of business intelligence.

Blending expert knowledge with cutting-edge technology, GlobalData’s unrivalled proprietary data will enable you to decode what’s happening in your market. You can make better informed decisions and gain a future-proof advantage over your competitors.